Bill and Jane share profits and losses in a 70:30 ratio. Mike is to be admitted into

Question:

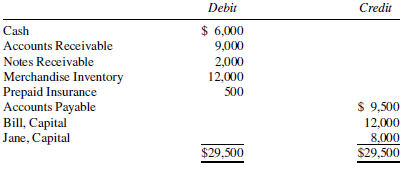

Bill and Jane share profits and losses in a 70:30 ratio. Mike is to be admitted into a partnership upon the investment of $14,000 for a one-third capital interest. Account balances for Bill and Jane on June 30, 2019 just before the admission of Mike are as follows:

It is agreed that for purposes of establishing the interests of the former partners, the following adjustments shall be made:

1. An allowance for doubtful accounts of 2% of the accounts receivable is to be established.

2. The merchandise inventory is to be valued at $10,000.

3. Accrued expenses of $600 are to be recognized.

4. Prepaid insurance is to be valued at $300.

5. The bonus method is to be used to record the admission of Mike.

Required:

Prepare the entries to adjust the account balances in establishing the interests of Bill and Jane and to record the investment by Mike.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer: