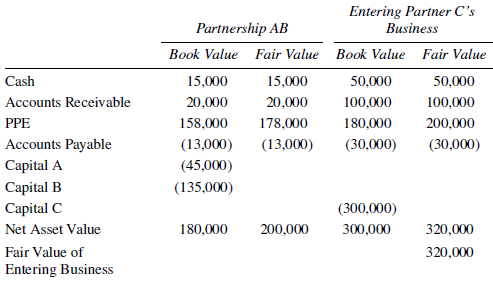

Partner C buys a 60% interest from the partnership by bringing her business to combine with that

Question:

Partner C buys a 60% interest from the partnership by bringing her business to combine with that of AB. Partners A and B share profits in a 3:1 ratio.

Required:

A. Does this admission qualify as a business combination under GAAP?

B. Determine which business is to be identified as the acquirer and which as the acquiree. Calculate the goodwill, if any, to be recorded on the books of the combined entity.

C. Prepare journal entries to record the entering business on the books of AB, including the adjustments to the capital accounts of all 3 partners, if needed.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: