Calculate the following: (a) The amount of dividends declared by Cherry in Year 4 (b) The reported

Question:

Calculate the following:

(a) The amount of dividends declared by Cherry in Year 4

(b) The reported profit of Cherry for Year 5

(c) The amount for non-controlling interest that would appear in the Year 6 consolidated income statement and statement of financial position

(d) The amount of goodwill that would appear on the December 31, Year 6, consolidated statement of financial position.

Peach Ltd. acquired 80% of the common shares of Cherry Company on January 1, Year 4. On that date, Cherry had common shares of $710,000 and retained earnings of $410,000.

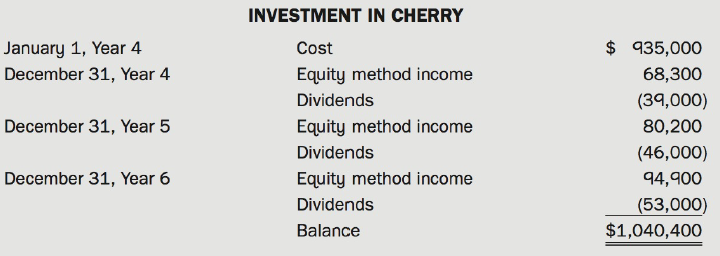

The following is a summary of the changes in Peach's investment account from January 1, Year 4, to December 31, Year 6:

Additional Information:

• Dividends declared by Cherry each year were eq,ual to 50% of Cherry's reported profit each year.

• On January 1, Year 4, the carrying amounts of the identifiable net assets of Cherry were equal to fair values.

• There was a goodwill impairment loss each year since the date of acquisition.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell