Citron Company is a U.S.-based citrus grower. On October 1, 2019, the company entered into a contract

Question:

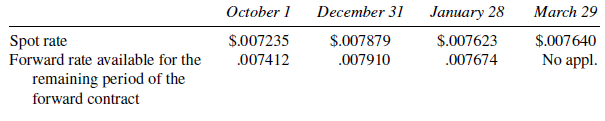

Citron Company is a U.S.-based citrus grower. On October 1, 2019, the company entered into a contract to ship 25,000 boxes of grapefruit on January 28 to Japan. Payment of 50,100,000 yen is to be received on March 29, 2020. On October 1, Citron also entered into a forward contract to sell 50,100,000 yen on March 29 at the forward rate of $.007412. The forward contract is considered a hedge of the unrecognized foreign currency commitment. The direct exchange rate and forward rate for the yen were as follows:

Required:

A. Prepare the necessary journal entries to record the following transactions and events: Oct. 1 Entered into the contract to sell the grapefruit and negotiated the forward contract.

Dec. 31 Fiscal year-end of Citron Company.

Jan. 28 The grapefruit were shipped FOB shipping point. The grapefruit cost Citron $7.50 per box. Citron uses a perpetual inventory system.

Mar. 29 Received the payment and delivered the yen to the exchange broker to settle the forward contract.

B. Compute the increase or decrease in income for each fiscal year as a result of the transactions above.

C. Compute the increase or decrease in income each period that would have occurred if Citron had not entered into the forward contract.

BrokerA broker is someone or something that acts as an intermediary third party, managing transactions between two other entities. A broker is a person or company authorized to buy and sell stocks or other investments. They are the ones responsible for... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer: