ASI recently completed the development and installation of an accounting information system for a company located in

Question:

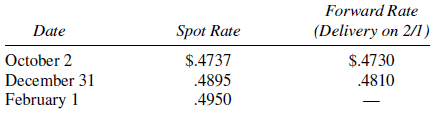

ASI recently completed the development and installation of an accounting information system for a company located in Rio De Janeiro, Brazil. The company considered that all revenue realization criteria were satisfied and accordingly recorded on October 2, 2019, a receivable from the foreign company. The receivable is to be settled in 120 days on February 1 by the delivery of 300,000 real. To hedge against an unfavorable change in the foreign exchange rate, ASI acquired a forward contract to sell 300,000 real on February 1 for $.4730 per real. The following exchange rates were quoted:

ASI is a calendar-year company.

Required:

A. Prepare the journal entries to record the transactions, adjust the accounts on December 31, and settle the receivable and forward contract on February 1.

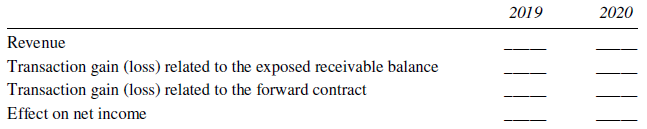

B. (1) Based on the data given above, complete the following table.

(2) What was the cumulative effect on net income (i.e., 2019 plus 2020)?

(3) How much cash was received when the account was settled?

Step by Step Answer: