On December 31, Year 1, Kelly Corporation of Toronto paid 13.7 million Libyan dinars (LD) for 100%

Question:

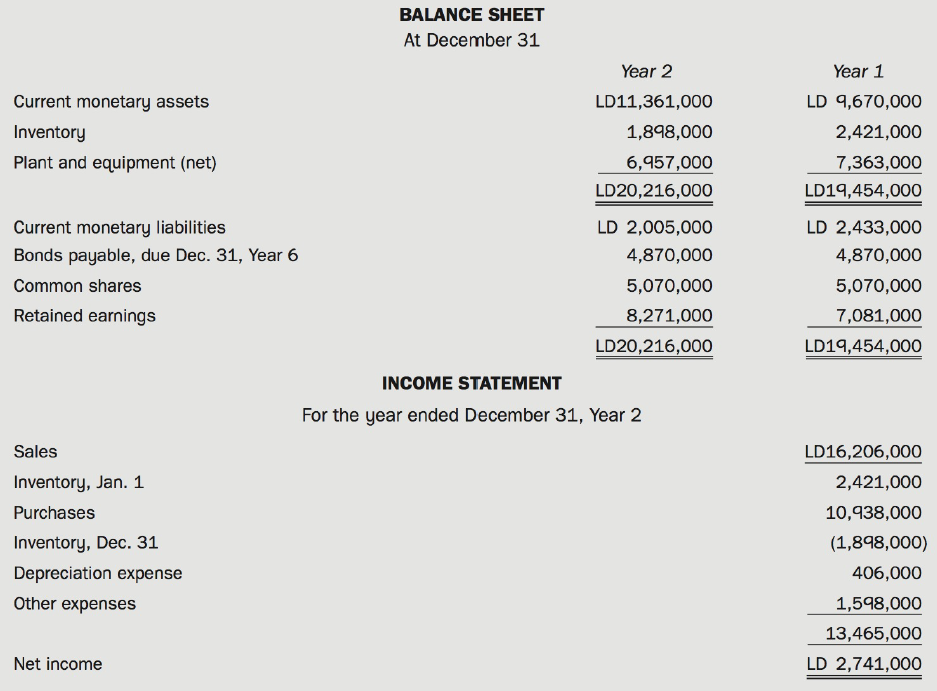

On December 31, Year 1, Kelly Corporation of Toronto paid 13.7 million Libyan dinars (LD) for 100% of the outstanding common shares of Arkenu Company of Libya. On this date, the fair values of Arkenu's identifiable assets and liabilities were equal to their carrying amounts. Arkenu's comparative balance sheets and Year 2 income statement are as follows:

Additional Information:

• Exchange rates

Dec. 31, Year 1 LD1 = $0.52

Sep. 30, Year 2 LD1 = $0.62

Dec. 31, Year 2 LD1 = $0.65

Average for Year 2 LD1 = $0.58

• Arkenu Company declared and paid dividends on September 30, Year 2.

• The inventories on hand on December 31, Year 2, were purchased when the exchange rate was LD1 = $0.63.

Required:

(a) Assume that Arkenu's functional currency is the Canadian dollar:

(i) Calculate the Year 2 exchange gain or loss that would result from the translation of Arkenu's financial statements.

(ii) Prepare translated financial statements for Year 2.

(b) Assume that Arkenu's functional currency is the Libyan dinar:

(i) Calculate the Year 2 exchange gain or loss that would result from the translation of Arkenu's financial statements.

(ii) Prepare translated financial statements for Year 2.

(iii) Calculate the amount of goodwill that would appear on the December 31, Year 2, consolidated balance sheet if there was an impairment loss of LD50,000 during the year.

(iv) Calculate the amount, description, and location of the exchange gain or loss that would appear in Kelly's Year 2 consolidated financial statements.

(c) Which functional currency would Arkenu prefer to use if it wants to show the following?

(i) The strongest solvency position for the company

(ii) The best return on shareholders' equity Briefly explain your answers.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell