On January 1, Beckman, Inc., acquires 60 percent of the outstanding stock of Calvin for $36,000. Calvin

Question:

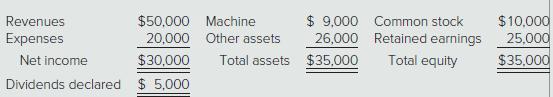

On January 1, Beckman, Inc., acquires 60 percent of the outstanding stock of Calvin for $36,000. Calvin Co. has one recorded asset, a specialized production machine with a book value of $10,000 and no liabilities. The fair value of the machine is $50,000, and the remaining useful life is estimated to be 10 years. Any remaining excess fair value is attributable to an unrecorded process trade secret with an estimated future life of four years. Calvin’s total acquisition-date fair value is $60,000. At the end of the year, Calvin reports the following in its financial statements:

Determine the amounts that Beckman should report in its year-end consolidated financial statements for noncontrolling interest in subsidiary income, noncontrolling interest, Calvin’s machine (net of accumulated depreciation), and the process trade secret.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik