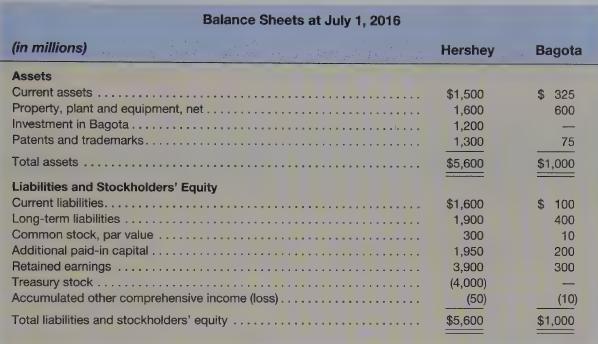

On July 1, 2016, The Hershey Company acquired 75 percent of the common stock of Bagota Organic

Question:

On July 1, 2016, The Hershey Company acquired 75 percent of the common stock of Bagota Organic Chocolates. The \($1.2\) billion purchase price was paid in cash and newly-issued debt securities. The acquisition entry is reflected below in the two companies’ balance sheets just after the acquisition.

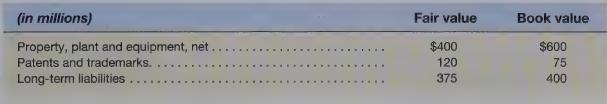

Independent appraisals produced the following fair value estimates for certain of Bagota’s previously recorded assets and liabilities. In addition, previously unreported customer-related intangibles have an estimated fair value of \($30\) million. Bagota’s noncontrolling interest has an estimated fair value of \($375\) million.

Required

a. Prepare a schedule to compute the total goodwill and its allocation to the controlling and noncontrolling interest.

b. Prepare a working paper to consolidate the balance sheets of Hershey and Bagota at July 1, 2016.

c. Prepare a formal consolidated balance sheet for Hershey and Bagota at July 1, 2016.

Step by Step Answer: