On May 31, 2004, Ike Loy was admitted to Jay & Kaye LLP by investing Loy Company,

Question:

On May 31, 2004, Ike Loy was admitted to Jay & Kaye LLP by investing Loy Company, a highly profitable proprietorship having identifiable tangible and intangible net assets of

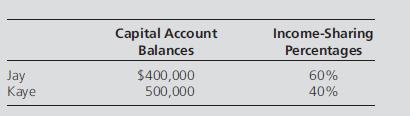

$600,000, at carrying amount and current fair value. Prior to Loy’s admission, capital account balances and income-sharing percentages of Jay and Kaye were as follows:

The partnership contract for the new Jay, Kaye & Loy LLP included the following provisions:

1. Loy was to receive a capital account balance of $660,000 on his admission to the partnership on May 31, 2004.

2. Income for the fiscal year ending May 31, 2005, and subsequent years was to be allocated as follows:

a. Bonus of 10% of income after the bonus to Loy.

b. Resultant net income or loss 30% to Jay, 20% to Kaye, and 50% to Loy.

Income before the bonus for the year ended May 31, 2005, was $132,000.

Prepare journal entries for Jay, Kaye & Loy LLP on May 31, 2004, and May 31, 2005 (the latter to accrue Loy’s bonus and to close the Income Summary ledger account having a credit balance of $120,000).

Step by Step Answer: