On September 10, 2017, the Globe Trading Company invested ($3,000,000) to establish a small sales subsidiary in

Question:

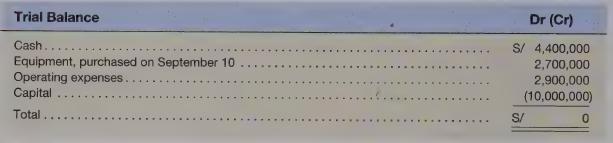

On September 10, 2017, the Globe Trading Company invested \($3,000,000\) to establish a small sales subsidiary in Lima, Peru. The subsidiary converted \($3,000,000\) into 10,000,000 new sols (S/) and opened a bank account in Lima. At December 31, 2017, the subsidiary reports the following trial balance:

The subsidiary reports no depreciation on the equipment in 2017. The exchange rate was \($0.33/S/\) on December 31, 2017, and averaged \($0.31/S/\) during the period from September 10 to December 31 20172 Other than the equipment purchase, all other payments occurred evenly over the period.

Required

a. Assuming the functional currency of the sales subsidiary is the U.S. dollar, prepare a schedule to compute the remeasurement gain or loss in 2017.

b. Assuming the functional currency of the subsidiary is the new sol, prepare a schedule to compute the translation gain or loss in 2017. :

c. For each functional currency alternative, give the entry or entries made by Globe at year-end, assuming Globe uses the complete equity method to report its investment in the sales subsidiary.

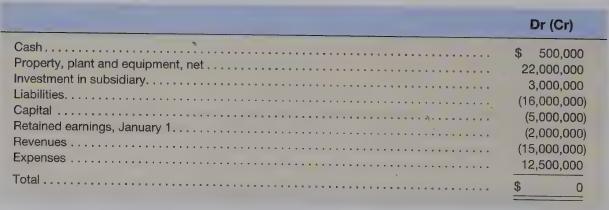

d. Globe’s trial balance at December 31, 2017, before year-end adjustments for its investment in the Lima subsidiary, is below. Prepare a working paper to consolidate the subsidiary, for each functional currency alternative.

Step by Step Answer: