Fairview Corporation, a U.S. company, has a wholly-owned subsidiary in Mexico. The subsidiary's functional currency is the

Question:

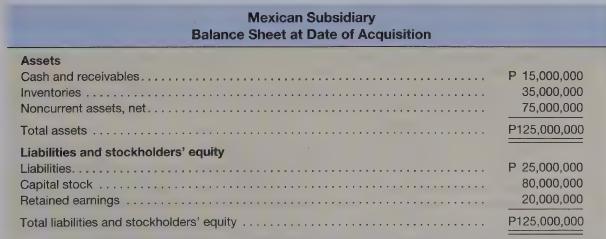

Fairview Corporation, a U.S. company, has a wholly-owned subsidiary in Mexico. The subsidiary's functional currency is the Mexican peso, and translation to U.S. dollars is appropriate. The subsidiary was acquired for \($18,000,000.\) The balance sheet of the subsidiary on the date of acquisition is as follows:

The fair values of the subsidiary’s inventories are P50,000,000, and the fair values of the subsidiary’s noncurrent assets are P70,000,000. All other amounts are reported at approximate fair value. The exchange rate at the date of acquisition is \($0.10/peso.\)

Required

Present a schedule showing the calculation of goodwill for the acquisition, in U.S. dollars, and the entries necessary to consolidate the balance sheets of Fairview and its subsidiary at the date of acquisition.

Step by Step Answer: