Pacific Athletic Corporation owns all of the voting stock of Solovair Apparel. Acquisition cost was ($10) million

Question:

Pacific Athletic Corporation owns all of the voting stock of Solovair Apparel. Acquisition cost was \($10\) million in excess of Solovair’s book value of \($2\) million, and the excess was attributed entirely to goodwill. As of the beginning of the current year, goodwill impairment is \($4\) million. Current year goodwill impairment is \($200,000.\) Following is information on intercompany transactions between Pacific and Solovair for the current year:

• Pacific sold land to Solovair in a previous year at a gain of \($300,000.\) Solovair sold the land to an outside party in the current year.

• Intercompany profit in Pacific’s beginning inventory, purchased from Solovair, is \($100,000.\)

• Intercompany profit in Pacific’s ending inventory, purchased from Solovair, is \($120,000.\)

• Total sales from Solovair to Pacific, at the price charged to Pacific, were \($5\) million.

• Solovair sold equipment with a book value of \($2\) million to Pacific three years ago for \($4.5\) million.

The equipment had a remaining life of five years, straight-line. Pacific has held the equipment for three years as of the end of the current year.

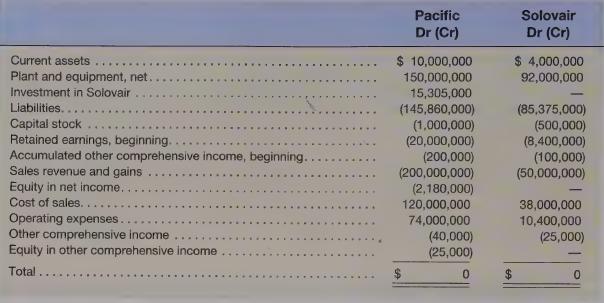

The separate trial balances for Pacific and Solovair at the end of the current year follow:

Required

Prepare a working paper to consolidate the trial balances of Pacific and Solovair. Label your eliminating entries (C), (I), (E), (R), and (O).

Step by Step Answer: