Suppose that on January 1, 2017, La-Z-Boy Inc. established a subsidiary in Ireland, La-Z-Boy Ireland, to design,

Question:

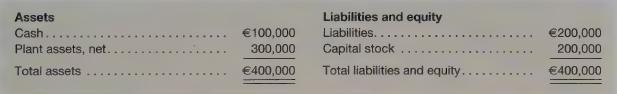

Suppose that on January 1, 2017, La-Z-Boy Inc. established a subsidiary in Ireland, La-Z-Boy Ireland, to design, manufacture and distribute specialized furniture in the European market. Its condensed balance sheet at January 1, 2017, in euros, is below (in thousands).

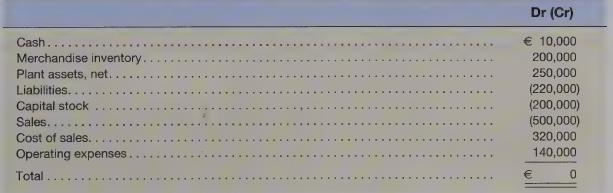

At December 31, 2017, La-Z-Boy Ireland reported the following condensed trial balance:

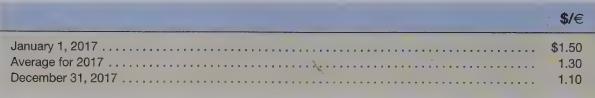

No dividends were declared or paid. Relevant exchange rates are as follows:

Required

a. Prepare a translated 2017 statement of comprehensive income and balance sheet for La-Z-Boy Ireland as of December 31, 2017, assuming the subsidiary’s functional currency is the euro. Include an analysis of the 2017 translation adjustment.

b. Assume that operating expenses include €50,000 of depreciation on the original plant assets, the merchandise inventory on hand at December 31 was acquired’ when the exchange rate was \($1.15,\) and merchandise purchases and cash operating expenses were incurred evenly during 2017. Repeat the requirements of part a, assuming the subsidiary’s functional currency is the U.S. dollar. Include a separate calculation of the remeasurement gain or loss for the year.

c. Compute the ratios of net income/sales and net income/total assets at December 31, 2017, using the euro financial statements and the translated and remeasured financial statements. Comment on the results.

d. Suppose the euro continues to weaken (\($/€\) continues to decline) in subsequent years. What will happen to the ratios computed in part c? Do the signals they provide indicate improving or deteriorating performance? Should La-Z-Boy’s management use the ratios as justification for additional investments in La-Z-Boy Ireland?

Step by Step Answer: