The City of Alexandria, VA finances its operations from revenues collected from property taxes, waste management fees,

Question:

The City of Alexandria, VA finances its operations from revenues collected from property taxes, waste management fees, municipal court fines, and interest on investments. Alexandria maintains only a general fund. Suppose the following information is available for the year ended December 31, 2016:

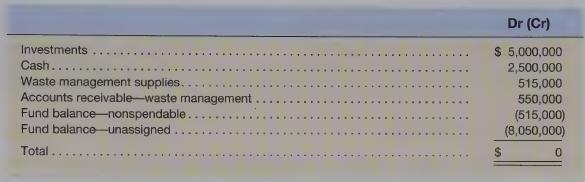

1. Following is the general fund trial balance on January 1, 2016:

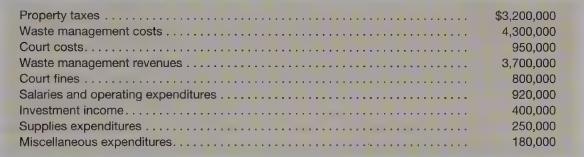

2. The budget for 2016, adopted by the town board, follows:

3. All property taxes were collected in cash. Waste management costs, all paid in cash, were \($4,290,000.

Court\) costs, all paid in cash, were \($920,000.\)

4. Waste management revenues of \($2,800,000\) were billed during the year. All outstanding waste management bills on January 1, 2016, were collected during 2016. All 2016 billings were paid with the exception of \($320,000,\) which were mailed to customers the last week of the year.

5. Court fines of \($850,000\) were collected in cash. Salaries and operating expenditures, all paid in cash, were \($880,000.\) Investment income of \($450,000\) accumulates in the investments account until the investments mature. No investments matured in 2016.

6. Miscellaneous expenditures, all paid in cash, were \($160,000.\)

7. Waste management supplies on hand at year-end were \($265,000.\) The town uses the consumption method to report supplies.

Required

a. Prepare 2016 journal entries to record the above events and to close the books for the year.

b. Prepare a statement of revenues, expenditures, and changes in fund balances and the balance sheet for 2016.

Step by Step Answer: