Assume that Nestl is updating its weighted-average cost of capital. The firm has altered its capiaal structure

Question:

Assume that Nestlé is updating its weighted-average cost of capital. The firm has altered its capiaal structure in recent years and wishes to use the revised redative weights of debt and equity in its capitalization with current costs of debt and equiry:

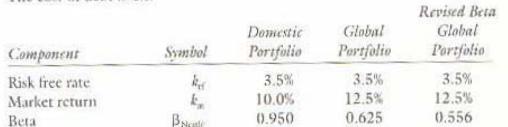

As discussed above, Nestlé can calculate its cost of capital from the traditional "domestic portfolio" approach or one that is based on the "global portfolio" approach. Nestlés CFO, Dr. Mario Corti, has now collected recent values for all alternative portfolios, as well as receiving a new estimate of its bera from one of its major banks, Union Bank of Swizerland (UBS). The cost of dcbt is \(4 \%\).

a. Calculate Nestle's cost of equity for the three different portfolio data sets.

b. UBS's new beta estimate was found using a methodology in which the beta itself is a moving average of how the individual security's covariance with the global market "trends" over time. It assumes that the trend will continue, and that Nestle's beta will continue to fall in value. What are the implications of the falling beta for Nestle's cost of capital?

c. If Nestle's debt/otal capitalization has recently changed from \(35 \%\) to \(45 \%\), how has its weighred-average cost of capital changed according to the three different portfolio constructions?

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton