Block plc has 6m of cash available for investment. Four possible projects have been identified. Each involves

Question:

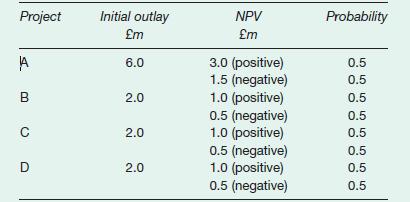

Block plc has £6m of cash available for investment. Four possible projects have been identified. Each involves an immediate outflow of cash and is seen as having two possible outcomes as regards the NPV. The required initial investment, possible NPVs and probabilities of each project are as follows:

The outcomes of the projects are completely independent of one another.

The business has decided to adopt one of two strategies.

l Strategy 1: Invest all of the cash in Project A.

l Strategy 2: Invest one-third of the cash in each of Projects B, C and D.

Deduce as much information as you can about the effective outcome of following each strategy.

Which of the two investment strategies would you recommend to the directors? Why?

What assumptions have you made about the directors and the shareholders in making your recommendation?

Would your recommendation have been different had more or less finance been involved in the decision?

Step by Step Answer: