Easton Ltd needs to purchase a machine to manufacture a new product. The choice lies between two

Question:

Easton Ltd needs to purchase a machine to manufacture a new product. The choice lies between two machines (A and B). Each machine has an estimated life of three years with no expected scrap value.

Machine A will cost £15 000 and Machine B will cost £20 000, payable immediately in each case. The total variable costs of manufacture of each unit are £1 if made on Machine A, but only £0.50 if made on Machine B. This is because Machine B is more sophisticated and requires less labour to operate it.

The product will sell for £4 each.

The demand for the product is uncertain but is estimated at 2000 units for each year, 3000 units for each year or 5000 units for each year. (Note that whatever sales volume level actually occurs, that level will apply to each year.)

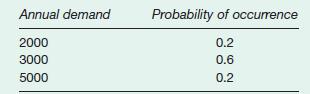

The sales manager has placed probabilities on the level of demand as follows:

Presume that both taxation and fixed costs will be unaffected by any decision made Easton Ltd’s cost of capital is 6 per cent p.a.

(a) Calculate the NPV for each of the three activity levels for each machine, A and B, and state your conclusion.

(b) Calculate the expected NPV for each machine and state your conclusion.

Step by Step Answer: