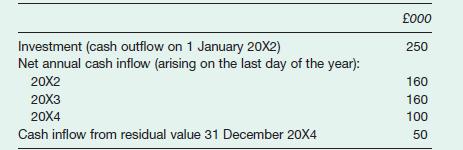

Dodd Ltd is assessing a business investment opportunity, Project X, the estimated cash flows for which are

Question:

Dodd Ltd is assessing a business investment opportunity, Project X, the estimated cash flows for which are as follows:

All of the above figures are expressed at 1 January 20X2 prices. Inflation is expected to operate at 5 per cent p.a. throughout the project’s life.

The business’s ‘real’ (that is, not taking account of inflation) cost of finance is estimated at 10 per cent p.a.

Corporation tax is charged on profits at the rate of 30 per cent, payable during the year in which the profit is earned (assume that the taxable profit equals the net operating cash flow). The asset, which will be bought in 20X2 and disposed of in 20X4, is of a type that does not give rise to any tax relief on its cost nor a tax charge on its disposal.

Calculate (using ‘money’ cash flows), the net present value of Project X.

Step by Step Answer: