Genedak-Hogans WACC and Effective Tax Rate. Many MNEs have greater ability to control and reduce their effective

Question:

Genedak-Hogan’s WACC and Effective Tax Rate.

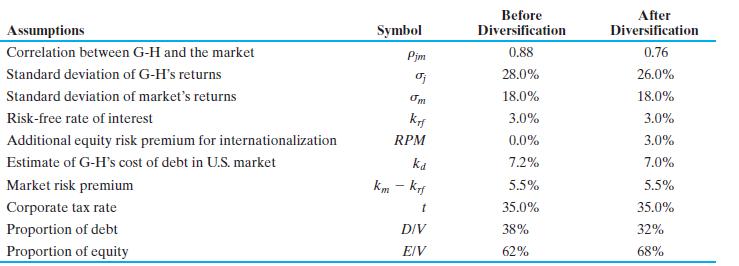

Many MNEs have greater ability to control and reduce their effective tax rates when expanding international operations. If Genedak-Hogan was able to reduce its consolidated effective tax rate from 35% to 32%, what would be the impact on its WACC?

Use the table below to answer this problem. Genedak-Hogan is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital structure and cost of capital. The firm is planning on reducing consolidated debt after diversification.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett

Question Posted: