Intervention in the foreign exchange market Argentina pegged its currency, the peso, to the US dollar at

Question:

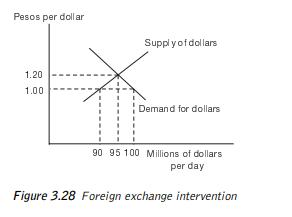

Intervention in the foreign exchange market Argentina pegged its currency, the peso, to the US dollar at a rate of 1 to 1 from April 1991 to November 2001. Under the rules of the currency board, the central bank must intervene to buy and sell dollars at this rate. For this reason, the Banco de la Republica Argentina backed its domestic currency issue with foreign exchange by the Convertibility Law, principally dollars. In Figure 3.28, the supply and demand for dollars is indicated:

a. If the Argentine government were to abandon the currency board, what would be the equilibrium exchange rate and the volume of dollars traded daily?

b. What amount of dollar reserves must the central bank of Argentina sell to the foreign exchange market daily in order to maintain its rigidly fixed exchange rate to the US dollar?

c. What is the impact of the sale of dollars on the Argentine money supply? Does this cause any adjustment process?

Step by Step Answer: