Kitchen Appliances plc is assessing an investment project that involves the production and marketing of a sophisticated

Question:

Kitchen Appliances plc is assessing an investment project that involves the production and marketing of a sophisticated household food mixer, the Rapido. The annual sales volume is expected to run at 10 000 Rapidos for five years.

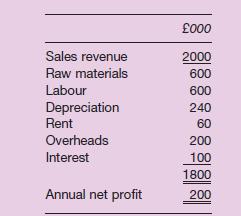

The development department has produced the following estimate of annual profit from the project:

The following additional information is relevant:

1 The production will require the purchase of a new machine at a cost of £1 200 000, payable on delivery. The machine will be depreciated on a straight-line basis over the five years. It is not expected to have any second-hand value at the end of that time.

2 Production of Rapidos will take place in a building currently used for storage. Apportioning the rent of the entire site occupied by the business on the basis of area, the building has a rental cost of £60 000. If production goes ahead, the business can rent a small warehouse, which will be adequate for storage purposes, for £10 000 p.a. payable annually in arrears.

If Rapido production is not undertaken there are plans to sublet the building to another business at a rent of £40 000 p.a. payable annually in arrears and to rent the small warehouse for £10 000 p.a.

3 £36 000 has been spent on developing the Rapido and £10 000 on a market survey to assess demand.

4 The overheads of £200 000 p.a. represent an apportionment of the overheads of the entire business on the basis of labour hours. The operating overheads will be increased by £90 000 p.a. as a result of Rapido manufacture. This includes £30 000 p.a. salary to a manager who is due to retire immediately on a pension of £10 000 p.a. If Rapido manufacture goes ahead, the manager will not retire for another five years. Staying on for the additional period will not affect the pension that the manager will ultimately receive. Pensions are paid by the business and the amounts are charged to non-operating overheads.

The remaining £60 000 represents salaries payable to two managers who will be taken on for the duration of the project, should it go ahead.

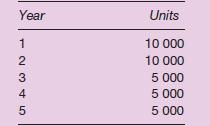

5 If Rapidos come on to the market there is expected to be a reduction in anticipated demand for the existing food mixer, the Whizzo, which the business also manufactures.

The reduction in the volume of Whizzo sales would be expected to be:

Whizzos sell at £80 each with variable costs of £40 each. Lower Whizzo sales volumes would not be expected to affect overhead costs, which are fixed.

6 The business’s corporation tax rate is 30 per cent and payment may be assumed to fall due at the end of the year concerned.

7 The expenditure on the new machine would attract capital allowances at the rate of 25 per cent p.a. with any unrelieved expenditure being allowed on disposal.

8 All of the data given are expressed in current terms. Inflation is expected to run at about 5 per cent p.a. over the next decade. All of the relevant cash flows are expected to increase at this annual rate.

9 The business’s after-tax cost of capital is (and is expected to remain at) 12 per cent p.a.

in money terms.

10 Working capital of £100 000 will be required from the start of the project and will be returned at the end of year 5.

(All of the above cash flows have been expressed in real terms, that is, in terms of prices at the date of the start of the project.)

On the basis of NPV should the project be undertaken or not?

Step by Step Answer: