One area within the balance of payments that has received intense interest in the past decade is

Question:

One area within the balance of payments that has received intense interest in the past decade is that of remittances.

The term remittance is a bit tricky. According to the International Monetary Fund (IMF), remittances are international transfers of funds sent by migrant workers from the country where they are working to people, typically family members, in the country from which they originated.

According to the IMF, a migrant is a person who comes to a country and stays, or intends to stay, for a year or more.

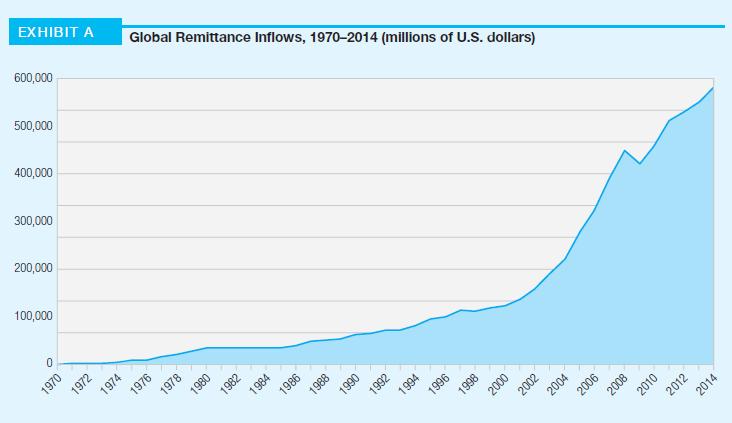

As illustrated by Exhibit A, it is estimated that nearly $600 billion was remitted across borders in 2014.

Remittances make up a very small, often negligible cash outflow from sending countries like the United States.

They do, however, represent a more significant volume, for example as a percent of GDP, for smaller receiving countries, typically developing countries, sometimes more than 25%. In many cases, this is greater than all development capital and aid flowing to these same countries.

And although the historical record on global remittances is short, as illustrated in Exhibit A, it has shown dramatic growth in the post-2000 period. Its growth has been rapid and dramatic, falling back only temporarily with the global financial crisis of 2008–2009, before returning to its rapid growth path once again from 2010 on.

Remittances largely reflect the income that is earned by migrant or guest workers in one country (source country)

and then returned to families or related parties in their home countries (receiving countries). Therefore it is, not surprising that although there are more migrant worker flows between developing countries, the highincome developed economies remain the main source of remittances. The global economic recession of 2009 resulted in reduced economic activities like construction and manufacturing in the major source countries; as a result, remittance cash flows fell in 2009 but rebounded slightly in 2010.

Most remittances occur as frequent small payments made through wire transfers or a variety of informal

channels (some even carried by hand). The United States Bureau of Economic Analysis (BEA), which is responsible for the compilation and reporting of U.S. balance of payments statistics, classifies migrant remittances as “current transfers” in the current account. Wider definitions of remittances may also include capital assets that migrants take with them to host countries and similar assets that migrants bring back with them to their home countries.

These values, when compiled, are generally reported under the capital account of the balance of payments. However, discerning exactly who is a “migrant,” is also an area of some debate. Transfers back to their home country made by individuals who may be working in a foreign country (for example, an expat working for a multinational organization)

but who are not c.........

Mini-Case Questions 1. Where are remittances across borders included within the balance of payments? Are they current or financial account components?

2. Under what conditions—for example, for which countries currently—are remittances significant contributors to the economy and overall balance of payments?

3. Why is the cost of remittances the subject of such intense international scrutiny?

4. What potential do new digital currencies—

cryptocurrencies like Bitcoin—have for cross-border remittances?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett