Pupule Travel. Pupule Travel, a Honolulu, Hawaiibased 100% privately owned travel company, has signed an agreement to

Question:

Pupule Travel. Pupule Travel, a Honolulu, Hawaiibased 100% privately owned travel company, has signed an agreement to acquire a 50% ownership share of Taichung Travel, a Taiwan-based privately owned travel agency specializing in servicing inbound customers from the United States and Canada. The acquisition price is 7 million Taiwan dollars (T$7,000,000)

payable in cash in three months.

Thomas Carson, Pupule Travel’s owner, believes the Taiwan dollar will either remain stable or decline slightly over the next three months. At the present spot rate of T$35/$, the amount of cash required is only

$200,000, but even this relatively modest amount will need to be borrowed personally by Thomas Carson.

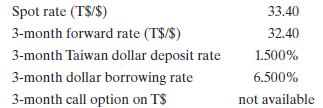

Taiwanese interest-bearing deposits by nonresidents are regulated by the government, and are currently set at 1.5% per year. He has a credit line with Bank of Hawaii for $200,000 with a current borrowing interest rate of 8% per year. He does not believe that he can calculate a credible weighted average cost of capital since he has no stock outstanding and his competitors are all also privately held. Since the acquisition would use up all his available credit, he wonders if he should hedge this transaction exposure. He has the following quotes from the Bank of Hawaii:

Analyze the costs and risks of each alternative, and then make a recommendation as to which alternative Thomas Carson should choose.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett