Sovereign Debt Negotiations. The Greek government is considering a 150 million loan for a four-year maturity. It

Question:

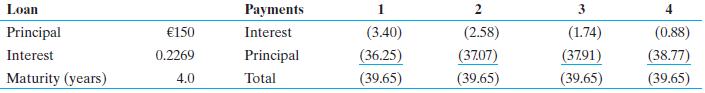

Sovereign Debt Negotiations. The Greek government is considering a €150 million loan for a four-year maturity.

It will be an amortizing loan, meaning that the interest and principal payments in total, annually, to a constant amount over the maturity of the loan. There is, however, a debate over the appropriate interest rate. The Greek government believes the appropriate rate for its current credit standing in the market today is 2.269%, but given the Greek government’s historical fiscal issues, several international banks with which it is negotiating are arguing that it is most likely 3.75%, and at the minimum 3.45%. What impact do these different interest rates have on the prospective annual payments?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292270081

15th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett