Saharan Debt Negotiations. The country of Sahara is negotiating a new loan agreement with a consortium of

Question:

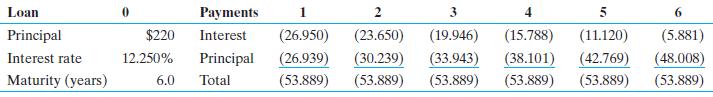

Saharan Debt Negotiations. The country of Sahara is negotiating a new loan agreement with a consortium of international banks. Both sides have a tentative agreement on the principal—$220 million. But there are still wide differences of opinion on the final interest rate and maturity. The banks would like a shorter loan, four years in length, while Sahara would prefer a long maturity of six years. The banks also believe the interest rate will need to be 12.250% per annum, but Sahara believes that is too high, arguing instead for 11.750%.

a. What would the annual amortizing loan payments be for the bank consortium’s proposal?

b. What would the annual amortizing loan payments be for Sahara’s loan preferences?

c. How much would annual payments drop on the bank consortium’s proposal if the same loan was stretched from four to six years?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292270081

15th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett