7. In Example 11.7 (firm investments), does the conclusion that a non-stationary AR1 model is preferred still

Question:

7. In Example 11.7 (firm investments), does the conclusion that a non-stationary AR1 model is preferred still hold true when permanent random subject effects are added to the model.

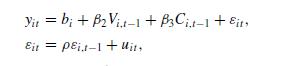

Thus

with ui t ∼ N(0, τ

−1) unstructured and bi centred at β1. There are only 10 firms, so a fixed subject effects approach may also be run to assess default assumptions such as bi normal.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: