1. To maximize LeClubs expected profit, how much of each of the wines in Table 13.11 should...

Question:

1. To maximize LeClub’s expected profit, how much of each of the wines in Table 13.11 should Zanella order?

2. If Zanella orders the quantity that maximizes expected profit, for each wine what is the probability that it will have inventory left over that must be discounted?

3. From the wines listed in Table 13.11, which are the most profitable and which are the least profitable? Why?

4. If Zanella decides that it must have at least a .75 in-stock probability with each wine, how much of each wine would it order? Do you recommend that it order those quantities?

5. How could Zanella improve his business?

Stéphane Zanella is the directeur général (general manager) of Le Club Français du Vin (The French Wine Club). Founded in 1973, Le Club is a large catalog retailer offering an exciting collection of French wines to consumers in France, Switzerland, and Germany. The mission of Le Club is to offer wines of good to very good quality to its members, who receive interesting wines delivered directly to their homes. Because most consumers in France purchase wine through their supermarkets (some with outstanding selections) and local specialty stores, Le Club capitalizes on a niche market. Le Club employs several wine experts and specializes in identifying small and midsize growers typically below the radar screen of the big French hypermarkets such as Carrefour and Champion.

Zanella’s current task is to decide Le Club’s order for the wines in an upcoming catalog. Ordering occurs several months before publishing the catalog and at a point when little information beyond the wine experts’ personal opinions is available. Upon receiving the order, the grower decorates the bottles with a label unique to Le Club and sends the order to Le Club’s warehouse in Dijon (some 300 km south of Paris). Le Club’s exclusive label prevents consumers from comparing prices with supermarket offerings and allows Le Club to enjoy comfortable gross margins of about 50 percent (i.e., Le Club sets its price to consumers at twice the price it pays to buy wine from growers). In addition to the cost of purchasing each bottle, Le Club incurs a €1.25 shipping and handling cost per bottle on its outbound shipments to customers (€ is the symbol for the euro). For example, for a bottle with a €10 retail price, Le Club pays about €5 in procurement costs and €1.25 to ship the bottle to the customer. Customers do not pay for shipping, but the growers pay for inbound shipping to the Dijon warehouse.

Zanella knows that if he buys too many bottles for a catalog season, then the excess bottles are stored in the warehouse and are discounted in a future catalog. As a rule of thumb, Zanella assumes that an overbought wine needs to be discounted by 35 percent off its retail price (i.e., a €10 bottle would be sold for €6.5) to liquidate the inventory. Each bottle sold through a discount page still incurs a €1.25 cost to ship the bottle to the customer. Furthermore, due to the extra time spent in the warehouse each discounted bottle incurs a €1.1 storage cost and an opportunity cost of capital equal to 15 percent of the purchase price. For example, a bottle Le Club purchases for €5 and sold through a discount page incurs a storage cost of €1.1 and an additional €0.75 for the opportunity cost of capital (15 percent of €5).

While it is costly to overbuy, Zanella knows that it can also be costly to be too conservative—given the long lead times in wine production, Le Club is generally unable to later place additional orders for wine. Thus, while Zanella knows he shouldn’t complain about selling out a wine, he also worries about the sales Le Club could have made had it ordered more.

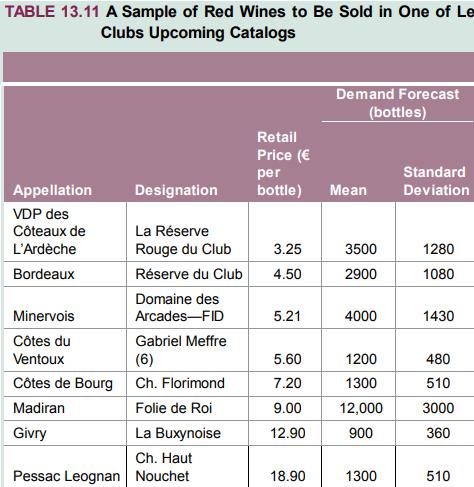

Although each catalog usually offers a selection of around 30 wines, including whites, reds, and rosés from different regions of France, Zanella decided to think carefully about the sample of eight red wines displayed in Table 13.11 for an upcoming catalog. Each wine occupies a different price point and the forecasts vary considerably, depending on the quality of the wine, where it will be included in the catalog (e.g., cover, back page, middle, etc.), and how much space it will be given in the catalog (e.g., full page, quarter page, etc.). Zanella would love its forecasts to be more accurate, but he also recognizes that tastes in wine are fickle. Still, sipping from a glass of the Pessac Leognan from Chateau Haut Nouchet, he wonders how a wine that tastes that good could possibly sell poorly.

Step by Step Answer:

Operations Management

ISBN: 9781260547610

2nd International Edition

Authors: Gerard Cachon, Christian Terwiesch