Kurt Hozak, VP of Operations at Monterrey Manufacturing, has to make a decision between two investment alternatives.

Question:

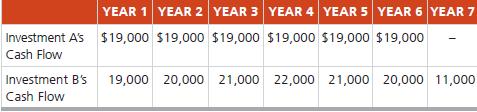

Kurt Hozak, VP of Operations at Monterrey Manufacturing, has to make a decision between two investment alternatives. Investment A has an initial cost of $61,000, and investment B has an initial cost of $74,000. The useful life of investment A is 6 years; the useful life of investment B is 7 years. Given a discount rate of 9% and the following cash flows for each alternative, determine the most desirable investment alternative according to the net present value criterion.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Operations Management Sustainability And Supply Chain Management

ISBN: 9780137476442

14th Edition

Authors: Jay Heizer, Barry Render, Chuck Munson

Question Posted: