Refer to Problem 12. Ozgun Demirag is now considering whether to conduct a test-marketing program before opening

Question:

Conducting the program will reduce each payoff for the various alternatives in Problem 8 by $10,000.

1. Given this new information, revise the decision tree you constructed for Problem 8.

2. Analyze the revised decision tree to advise Ozgun about the decision she should make.

Data from problem 12

Ozgun Demirag, the owner of a high-end U.S. apparel store, Feminine Fashions, is planning to open another facility in her hometown of Izmir, Turkey. Demirag can open a large store, a small store, or, to hedge her bets, she could open a medium-sized store. The market for high-end apparel in Izmir could be favorable or unfavorable. If the market is favorable, a large store will earn Ozgun a payoff of $200,000. Nevertheless, if the market is unfavorable, she will suffer a net loss of $180,000. If she opens a medium-sized store and the market is unfavorable, her loss will be $100,000. By contrast, a favorable market for a medium-sized store will generate a payoff of $140,000. A small store with a favorable market will result in a payoff of $ 60,000 but a payoff of €“$20,000 if the market is unfavorable. The probability of a favorable market is 0.60 and that of an unfavorable market is 0.4.

Data from problem 8

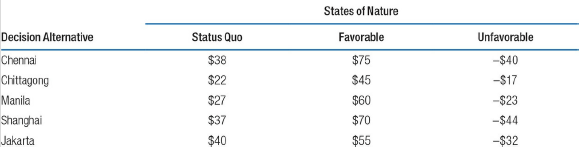

AMCO International, a major apparel retail company, has several stores in the United States and in countries throughout the globe. It imports most of its apparel products and garments from overseas suppliers. To improve its global supply chain operations, the company wants to contract with a single supplier located in one of the major ports around the world who can supply the majority of the apparel products it needs. The company is considering five major garment and apparel suppliers in the following major port cities: Chennai, India; Chittagong, Bangladesh; Manila, Philippines; Shanghai, China; and Jakarta, Indonesia. AMCO International has estimated the future profits (or loss) it may achieve will depend on a variety of future conditions (states of nature) including market conditions, exchange rates, quality of second and third tier suppliers, security issues, port capacity, and ship and container availability. These future conditions can be classified into three categories: status quo (no change), favorable, and unfavorable. Table F.22 summarizes the payoffs (in $ millions) from each of the overseas supplier for the three different states of nature.

Table F.22

Step by Step Answer:

Operations Management Managing Global Supply Chains

ISBN: 978-1506302935

1st edition

Authors: Ray R. Venkataraman, Jeffrey K. Pinto