Question: A pan with a rock in it is floating in water. Suppose you remove the rock and use a very lightweight string to suspend it

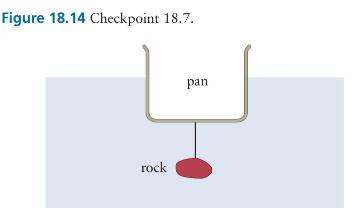

A pan with a rock in it is floating in water. Suppose you remove the rock and use a very lightweight string to suspend it from the bottom of the pan (Figure 18.14). If the combination still floats, is the volume of water displaced when the rock is suspended greater than, equal to, or smaller than the volume of water displaced when the rock is in the pan?

Figure 18.14 Checkpoint 18.7. rock pan

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Equal Because the panrock combination floats in both cases the buoyant force exerted in both cases ... View full answer

Get step-by-step solutions from verified subject matter experts