The information listed below refers to the employees of Brennan Company for the year ended December 31,

Question:

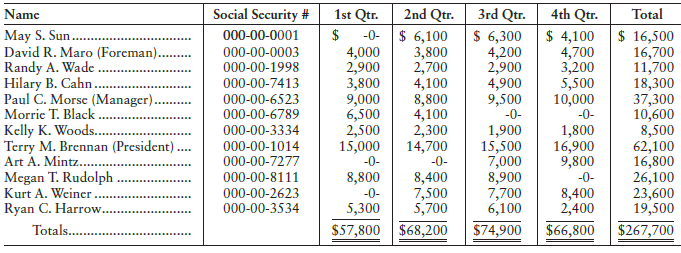

The information listed below refers to the employees of Brennan Company for the year ended December 31, 2018. The wages are separated into the quarters in which they were paid to the individual employees.

For 2018, State D’s contribution rate for Brennan Company, based on the experience-rating system of the state, was 3.6% of the first $7,000 of each employee’s earnings. The state tax returns are due one month after the end of each calendar quarter. During 2018, the company paid $3,024.00 of contributions to State D’s unemployment fund.

Employer’s phone number: (613) 555-0029. Employer’s State D reporting number: 00596.

Using the forms supplied on pages 5-56 to 5-58, complete the following for 2018:

a. The last payment of the year is used to pay the FUTA tax for the fourth quarter (the first three-quarter’s liability was more than the $500 threshold). State D is not a credit reduction state.

Tax Payment:

Date _________________ Amount $_________________

b. Employer’s Report for Unemployment Compensation, State D—4th quarter only. Item 1 is the number of employees employed in the pay period that includes the 12th of each month in the quarter. For Brennan Company, the number of employees is ten in October, nine in November, and eight in December. All employees earned 13 credit weeks during the last quarter except for Sun (8) and Harrow (9).

c. Employer’s Annual Federal Unemployment (FUTA) Tax Return—Form 940 Indicate on each form the date that the form should be submitted and the amount of money that must be paid.

The president of the company prepares and signs all tax forms.

Step by Step Answer: