Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to

Question:

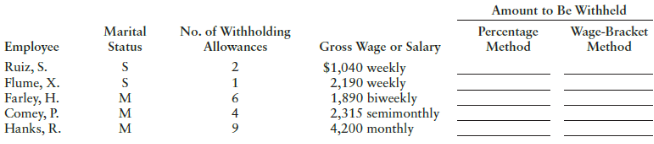

Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee.

Transcribed Image Text:

Amount to Be Withheld Marital Status No. of Withholding Allowances 2 Percentage Method Wage-Bracket Gross Wage or Salary $1,040 weekly 2,190 weekly 1,890 biweekly 2,315 semimonthly 4,200 monthly Method Employee Ruiz, S. Flume, X. Farley, H. |Comey, P. Hanks, R. 6. м

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (18 reviews)

a 104000 27790 88420 77400 11020 025 2755 10050 12805 b 219000 ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Use the percentage method to compute the federal income taxes to withhold from the wages or salaries of eachemployee. Employee Employee Marital Status No. of Withholding Allowances 4 0 Amount to Be...

-

Use the percentage method to word the federal income taxes to withhold from the wages or salaries of each employee. No. of Withholding Gross Wage or Employee No. Marital Amount to Be Withheld...

-

Use the percentage method to word the federal income taxes to withhold from the wages or salaries of each employee. No. of Withholding Amount to Be Withheld Employee No. Employee Marital Status Gross...

-

Write a SET client SpellChecker that takes as a commandline argument the name of a file containing a dictionary of words, and then reads strings from standard input and prints any string that is not...

-

Consider the 8 5 grid shown in Fig. 1.13. How many different rectangles (with integer-coordinate comers) does this grid contain? [For example, there is a rectangle (square) with comers (1, 1), (2,...

-

The metric unit of energy, the joule (J), can be expressed as kg s 2 m 2 . Simplify these units and include newtons and only positive exponents in the final result.

-

What is the difference between a permanent fund and a private-purpose trust fund? AppendixLO1

-

Big Wave Marine experienced these events during the current year. a. December revenue totaled $120,000, and in addition, Big Wave collected sales tax of 5%. The tax amount will be sent to the state...

-

A will is presumed to be irrevocable unless the power to revoke is expressly stated. Pick the best answer: True or False

-

A consumer group claims that the mean annual consumption of high fructose corn syrup by a person in the United States is 48.8 pounds. A random sample of 120 people in the United States has a mean...

-

Herman Swayne is a waiter at the Dixie Hotel. In his first weekly pay in March, he earned $360.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($700.00),...

-

Youngston Company (a Massachusetts employer) wants to give a holiday bonus check of $750 to each employee. Since it wants the check amount to be $750, it will need to gross-up the amount of the...

-

Jason Stedman is the director of finance for Burton Manufacturing, a U.S.-based manufacturer of hand-held computer systems for inventory management. Burton's system combines a low-cost active tag...

-

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below. Income Statement Stmt...

-

TBTF Incorporated purchased equipment on May 1, 2021. The company depreciates its equipment using the double-declining balance method. Other information pertaining to the equipment purchased by TBTF...

-

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit $6 Variable cost per unit $3 Sales mix 4 Dark...

-

Data related to 2018 operations for Constaga Products, a manufacturer of sewing machines: Sales volume 5,000 units Sales price $300.00 per unit Variable production costs Direct materials 75.00 per...

-

6. (20 points) Sections 3.1-3.5, 3.7 Differentiate the following functions, state the regions where the functions are analytic. a. cos(e*) b. 1 ez +1 c. Log (z+1) (Hint: To find where it is analytic,...

-

For the following exercises, identify whether the statement represents an exponential function. Explain. The value of a coin collection has increased by 3.25% annually over the last 20 years.

-

Wholesalers Ltd. deals in the sale of foodstuffs to retailers. Owing to economic depression, the firm intends to relax its credit policy to boost productivity and sales. The firms current credit...

-

Samantha Montgomery (age 42) is employed by Canon Company and is paid a salary of $62,430. She has just decided to join the company's Simple Retirement Account (IRA form) and has a few questions....

-

During the past week, one of your newly employed payroll associates dropped into your office to ask several questions regarding wage reporting for federal income and social security tax purposes. If...

-

Yeager Company pays John Kerr a salary as an employee and also fees for work he does as an independent contractor. Does this violate IRS rules?

-

Eye Deal Optometry leased vision - testing equipment from Insight Machines on January 1 , 2 0 2 4 . Insight Machines manufactured the equipment at a cost of $ 2 0 0 , 0 0 0 and lists a cash selling...

-

help! ee all photos + Add to o e D C N X Edit & Create Share Table of Contents No sales to an individual customer accounted for more than 10% of revenue during any of the last three fiscal years. Net...

-

Business law A person may have the liability of a partner even though no partnership exists True False

Study smarter with the SolutionInn App