Kit is reviewing benefits with you, the payroll accountant for Silly Lemon Films. Classify the following benefits

Question:

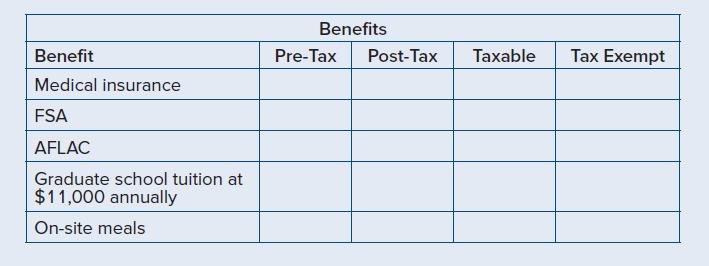

Kit is reviewing benefits with you, the payroll accountant for Silly Lemon Films. Classify the following benefits as pre-tax or post-tax deductions and as taxable or tax-exempt for federal income tax.

Transcribed Image Text:

Benefit Medical insurance FSA AFLAC Graduate school tuition at $11,000 annually On-site meals Benefits Pre-Tax Post-Tax Taxable Tax Exempt

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

Here is the classification of benefits as pretax or posttax deductions and as taxable or taxexempt f...View the full answer

Answered By

Dulal Roy

As a tutor, I have gained extensive hands-on experience working with students one-on-one and in small group settings. I have developed the ability to effectively assess my students' strengths and weaknesses, and to customize my teaching approach to meet their individual needs.

I am proficient at breaking down complex concepts into simpler, more digestible pieces, and at using a variety of teaching methods (such as visual aids, examples, and interactive exercises) to engage my students and help them understand and retain the material.

I have also gained a lot of experience in providing feedback and guidance to my students, helping them to develop their problem-solving skills and to become more independent learners. Overall, my hands-on experience as a tutor has given me a deep understanding of how to effectively support and encourage students in their learning journey.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

The payroll accountant for Candor, inc was found to have issued payroll checks in the name of several terminated employees Upon investigation, the checks were all deposited to the same bank account...

-

You are the Payroll Accountant for Olney Company, Inc., a small manufacturing firm located in Allentown, PA. Your manager, Director of Human Resources, is in the process of determining if and when...

-

You are the payroll accountant for Multi Winds Energy of Cornelius, North Carolina, whose employees are paid biweekly. An employee, L. Larson, comes to you on September 14 and requests a pay advance...

-

MidWest Amusements is in the process of reviewing 10 proposals for new rides at its theme parks in cities scattered throughout the American heartland. The companys only experienced safety engineer...

-

Calculating the Fixed Overhead Spending and Volume Variances Standish Company manufactures consumer products and provided the following information for the month of February: Units...

-

Describe the current trends in the food service industry. How and why are they changing? LO.1

-

Can you think of any circumstances where deferring conflict might be a wise course of action? LO6

-

Sergey Company has gathered the information shown below about its product. Direct materials: Each unit of product contains 4.5 pounds of materials. The average waste and spoilage per unit produced...

-

The income statement of Blue Spruce Corporation is presented here. BLUE SPRUCE CORPORATION Income Statement Year Ended November 30, 2018 Sales $8,200,000 Cost of goods sold 4,750,000 Gross profit...

-

The breaking strength of a fiber is required to be at least 150 psi. Past experience has indicated that the standard deviation of breaking strength is = 3 psi. A random sample of four specimens is...

-

The owner of Padua Products wants to reward the employees for their work during the year and asked you to gross-up their bonuses so that they receive the full amount as net pay. What amount(s) should...

-

Did you know that you can use an online calculator to see how your voluntary deductions will affect your paycheck? Many different payroll calculators exist. Go to one or more of the following sites...

-

What factors are usually considered when approving a project?

-

Based on the following information, calculate the sustainable growth rate for Kaleb's Welding Supply: Profit margin Capital intensity ratio Debt-equity ratio Net income Dividends 7.5% 0.65 0.60...

-

Waterway Inc. uses LIFO inventory costing. At January 1, 2025, inventory was $216,014 at both cost and market value. At December 31, 2025, the inventory was $283,252 at cost and $262,660 at market...

-

What is the 32-bit version of: 0000 0000 0001 0101

-

1. Let A = 2 1 4 3 Find AT, A-1, (A-1) and (AT)-1. 2. Let A = = [ -1 -1 2 22 (a) Find (AB), BT AT and AT BT. (b) (AB)-1, B-1A-1 and A-B-1. ] 1-5 and B = 1

-

Xavier Ltd. paid out cash dividends at the end of each year as follows: Year Dividend Paid 2018 $250,000 2019 $325,000 2020 $400,000 Assume that Xavier had 100,000 common shares and 5,000, $4,...

-

Hang time. LeBron James decides to jump high enough to dunk a basketball. What is the approximate force between the floor and his feet while he is jumping from the floor?

-

Diamond Walker sells homemade knit scarves for $25 each at local craft shows. Her contribution margin ratio is 60%. Currently, the craft show entrance fees cost Diamond $1,500 per year. The craft...

-

Are the benefits and limitations of a canned presentation any different if it is supported with a Power- Point presentation or DVD than if it is just a person talking? Why or why not?

-

How would our economy operate if personal salespeople were outlawed? Could the economy work? If so, how? If not, what is the minimum personal selling effort necessary? Could this minimum personal...

-

Franco Welles, sales manager for Nanek, Inc., is trying to decide whether to pay a sales rep for a new territory with straight commission or a combination plan. He wants to evaluate possible plansto...

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App