Marbury is the payroll accountant at Alls Fair Gifts. The employees of Alls Fair Gifts are paid

Question:

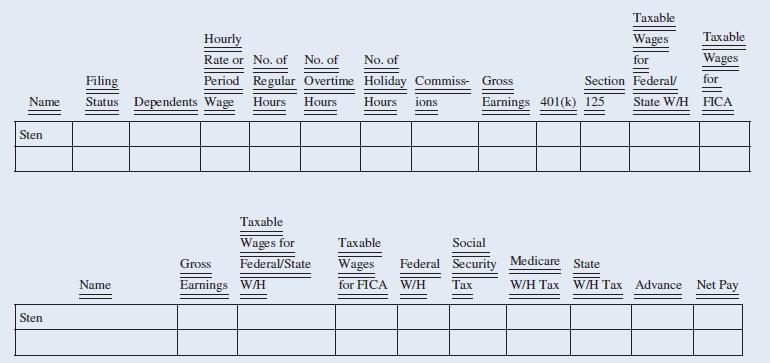

Marbury is the payroll accountant at All’s Fair Gifts. The employees of All’s Fair Gifts are paid semimonthly. Sten comes to Marbury on April 7 and requests a pay advance of $1,000, which Sten will pay back in equal parts on the April 15 and May 15 paychecks. Sten is single, with one dependent under 17, is paid $50,000 per year, contributes 3 percent of gross pay to a 401(k), and has $125 per paycheck deducted for a Section 125 plan. Compute the net pay on Sten’s April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the wage-bracket method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine the federal income tax. Assume box 2 is not checked.

Step by Step Answer:

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer