Using the information from P6-10B for Castor Corporation, complete Form W-3 that must accompany the companys Form

Question:

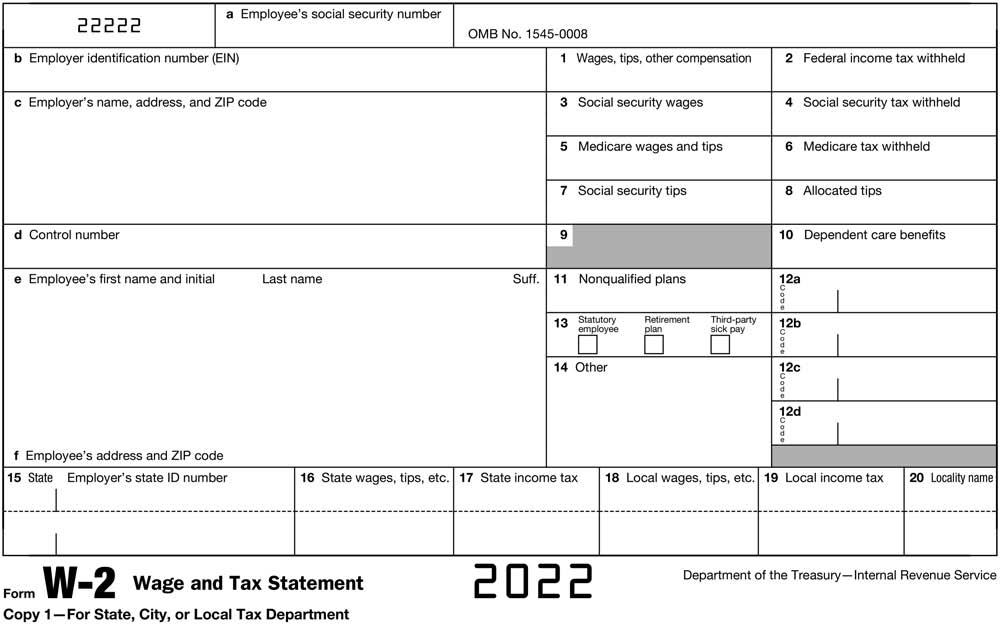

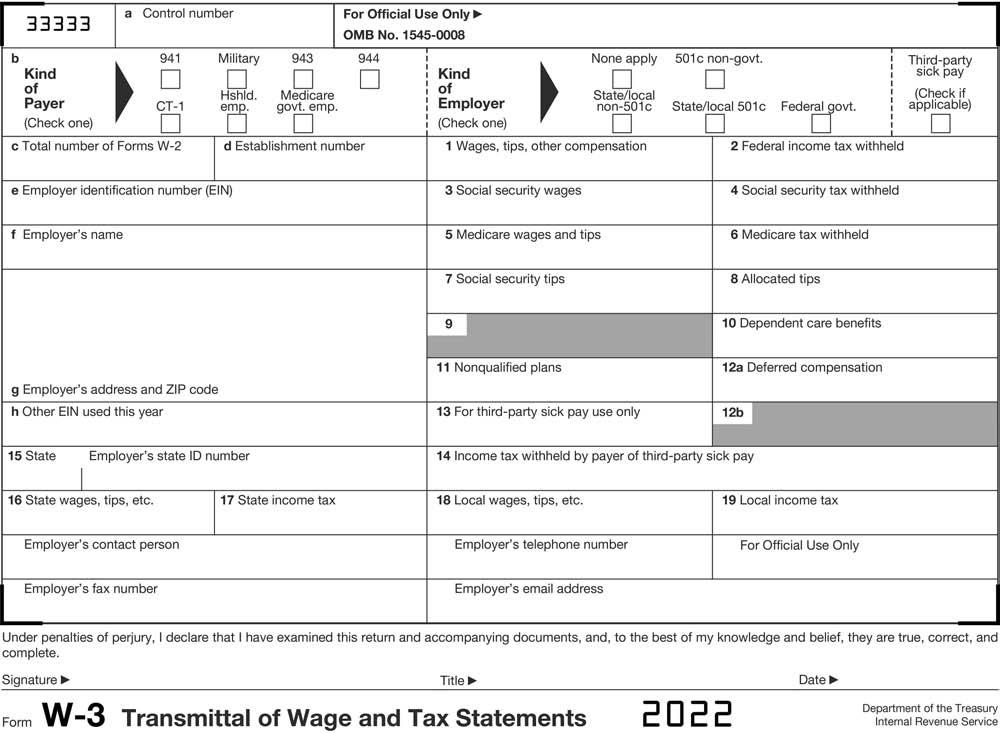

Using the information from P6-10B for Castor Corporation, complete Form W-3 that must accompany the company’s Form W-2s. Castor Corporation is a 941 payer and is a private, for-profit company. No third-party sick pay was applied for 2022. The W-3 was signed and submitted on January 12, 2023.

Transcribed Image Text:

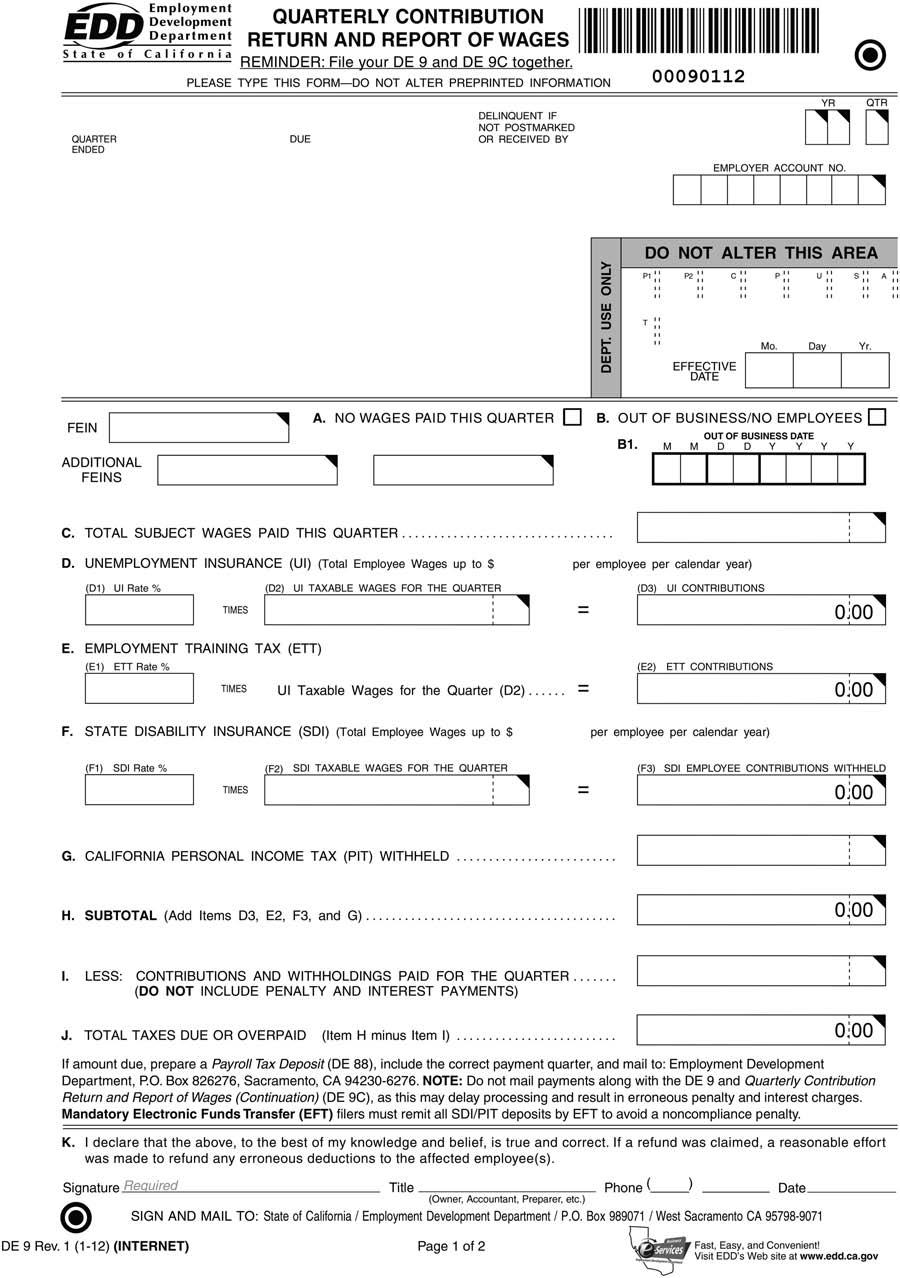

Employment QUARTERLY CONTRIBUTION EDD Development RETURN AND REPORT OF WAGES State of California REMINDER: File your DE 9 and DE 9C together. Department PLEASE TYPE THIS FORM-DO NOT ALTER PREPRINTED INFORMATION QUARTER ENDED FEIN ADDITIONAL FEINS C. TOTAL SUBJECT WAGES PAID THIS QUARTER D. UNEMPLOYMENT INSURANCE (UI) (Total Employee Wages up to $ (D1) UI Rate % (D2) UI TAXABLE WAGES FOR THE QUARTER TIMES (F1) SDI Rate % DUE E. EMPLOYMENT TRAINING TAX (ETT) (E1) ETT Rate % F. STATE DISABILITY INSURANCE (SDI) (Total Employee Wages up to $ TIMES DELINQUENT IF NOT POSTMARKED OR RECEIVED BY TIMES UI Taxable Wages for the Quarter (D2). G. CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD DE 9 Rev. 1 (1-12) (INTERNET) (F2) SDI TAXABLE WAGES FOR THE QUARTER H. SUBTOTAL (Add Items D3, E2, F3, and G) I. LESS: CONTRIBUTIONS AND WITHHOLDINGS PAID FOR THE QUARTER (DO NOT INCLUDE PENALTY AND INTEREST PAYMENTS) = DEPT. USE ONLY = = 00090112 Pt .. 11 11 P2 !! 11 DO NOT ALTER THIS AREA 41 C"! 44 EMPLOYER ACCOUNT NO. A. NO WAGES PAID THIS QUARTER B. OUT OF BUSINESS/NO EMPLOYEES OUT OF BUSINESS DATE B1. M MDD Y Y Y EFFECTIVE DATE per employee per calendar year) (D3) UI CONTRIBUTIONS "1 Mo. YR P!! 11 " (E2) ETT CONTRIBUTIONS per employee per calendar year) U !! 11 11 Day O QTR S!! A Phone() Date. (Owner, Accountant, Preparer, etc.) SIGN AND MAIL TO: State of California / Employment Development Department / P.O. Box 989071/West Sacramento CA 95798-9071 Page 1 of 2 ** "1 Yr. 0:00 0:00 (F3) SDI EMPLOYEE CONTRIBUTIONS WITHHELD 0:00 0,00 J. TOTAL TAXES DUE OR OVERPAID (Item H minus Item 1) If amount due, prepare a Payroll Tax Deposit (DE 88), include the correct payment quarter, and mail to: Employment Development Department, P.O. Box 826276, Sacramento, CA 94230-6276. NOTE: Do not mail payments along with the DE 9 and Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C), as this may delay processing and result in erroneous penalty and interest charges. Mandatory Electronic Funds Transfer (EFT) filers must remit all SDI/PIT deposits by EFT to avoid a noncompliance penalty. 0:00 K. I declare that the above, to the best of my knowledge and belief, is true and correct. If a refund was claimed, a reasonable effort was made to refund any erroneous deductions to the affected employee(s).. Signature Required Title Services Fast, Easy, and Convenient! Services Visit EDD's Web site at www.edd.ca.gov 11 #1 "1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (10 reviews)

To fill out Form W3 for the Castor Corporation you need the aggregate information from all the Forms W2 that the corporation issued to its employees f...View the full answer

Answered By

John Aketch

I have a 10 years tutoring experience and I have helped thousands of students to accomplish their educational endeavors globally. What interests me most is when I see my students being succeeding in their classwork. I am confident that I will bring a great change to thins organization if granted the opportunity. Thanks

5.00+

8+ Reviews

18+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Using the information from P6-10A for Leda, Inc., completed Form W-3 must accompany the companys W-2 forms. Leda, Inc., is a 941 payer and is a private, for-profit company. Kieran Leda is the owner;...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Its estimated that the average corporate user sends and receives some 112 e-mails daily.78 Thats about 14 e-mails per hour, and even if half of those dont require a lot of time and concentration,...

-

For subgroups of n = 4, what is the value of a. the d2 factor? b. the d3 factor? c. the D3 factor? d. the D4 factor? e. the A2 factor?

-

7. LO.2, 6 Camilos property, with an adjusted basis of $155,000, is condemned by the state. Camilo receives property with a fair market value of $180,000 as compensation for the property taken. a....

-

A cross-channel shopper is __________________.

-

On January 1, 2009, the Sato Company adopted the dollar-value LIFO method of inventory costing. The companys ending inventory records appear as follows: Required Compute the ending inventory for the...

-

14 Required information Problem 11-2A Analyzing and computing payback period, accounting rate of return, and net present value LO P1, P2, P3 [The following information applies to the questions...

-

Using the payroll register from P7-1A for White Mountain Assessments, complete the General Journal entry for the employers share of the payroll taxes for the September 9 payroll end date. Assume 5.4...

-

Using the information from P6-6A, complete the following Form 941 for the first quarter of 2022. The report was signed on April 15, 2022. EIN: 78-7654398 Address: 23051 Old Redwood Highway,...

-

A copper cylinder with a diameter of 3 in is initially at a uniform temperature of 70 F. How long after being placed in a medium at 1000 F with an associated convective heat-transfer coefficient of 4...

-

Mijka Company was started on January 1, Year 1. During Year 1, the company experienced the following three accounting events: 1. earned cash revenues of $32,500 2. paid cash expenses of $14,500 3....

-

Q2. Find the equations of the tangent and normal to the curve x3 + y = 2 at (1, 1). Q3. Find if y dx y= :xsinx + (sinx)cosx [10] [10]

-

Assume you have been given $400,000 CAD with access to all listed stocks, bonds, futures, and options worldwide. You can trade in options and futures, in combination with the underlying asset....

-

The formula weight (FW) of a gas can be determined using the following form of the ideal gas law FW = g R T / PV where g is the mass in grams, R is the gas constant, T is the temperature in Kelvin, P...

-

Consider a game in which a fair die is thrown. The player pays $5 to play and wins $2 for each dot that appears on the roll. Define X = number on which the die lands, and Y = player's net profit...

-

In the shareholders equity section of its 2013 and 2014 balance sheets, H&R Block reported accumulated other comprehensive income balances of $5.177 million and $1.74 million, respectively. The 2014...

-

Using a graphing utility, graph y = cot -1 x.

-

What was managements primary concern in deciding to implement an activity-based costing system?

-

What selling costs and general and administrative costs might be allocated to products using activity- based costing? Why do some managers prefer allocating these costs to products?

-

What are service departments? Why do some managers allocate service department costs to production departments?

-

) A form used to organize and check data before preparing financial reports is known as a(n):A) statement of financial position.B) income statement.C) ledger. D) worksheet.2) Bringing account...

-

16) The entry to record the payment of office salaries would be: A) Debit Cash; Credit Salaries PayableB) Debit Cash; Credit Salaries ExpenseC) Debit Salaries Expense; Credit Accounts PayableD) Debit...

-

9) The general journal:A) is the book of original entry.B) is the book of final entry.C) contains account balances.D) is completed after the closing entries.10) The process of initially recording...

Study smarter with the SolutionInn App