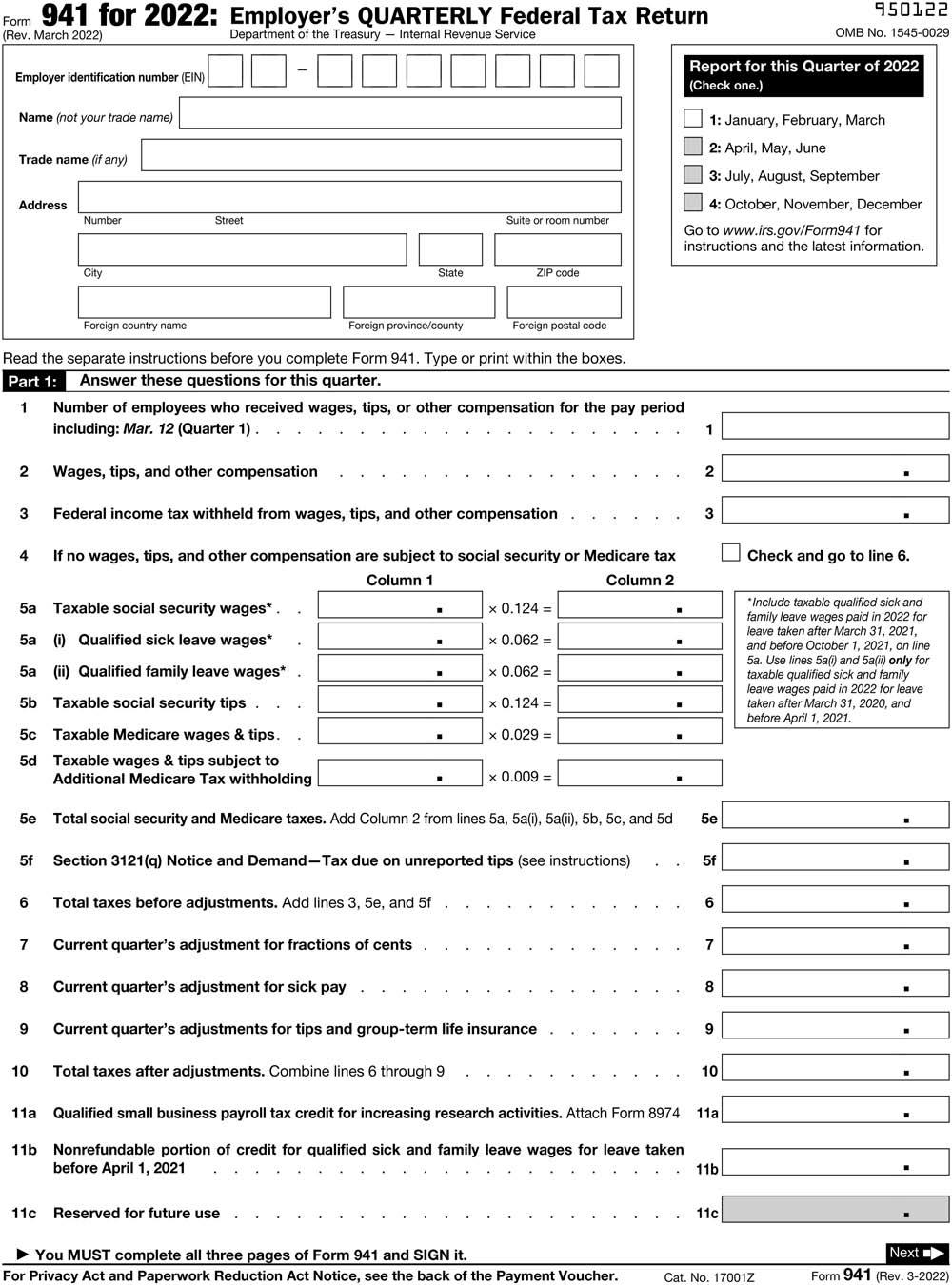

Using the information from P6-6A, complete the following Form 941 for the first quarter of 2022. The

Question:

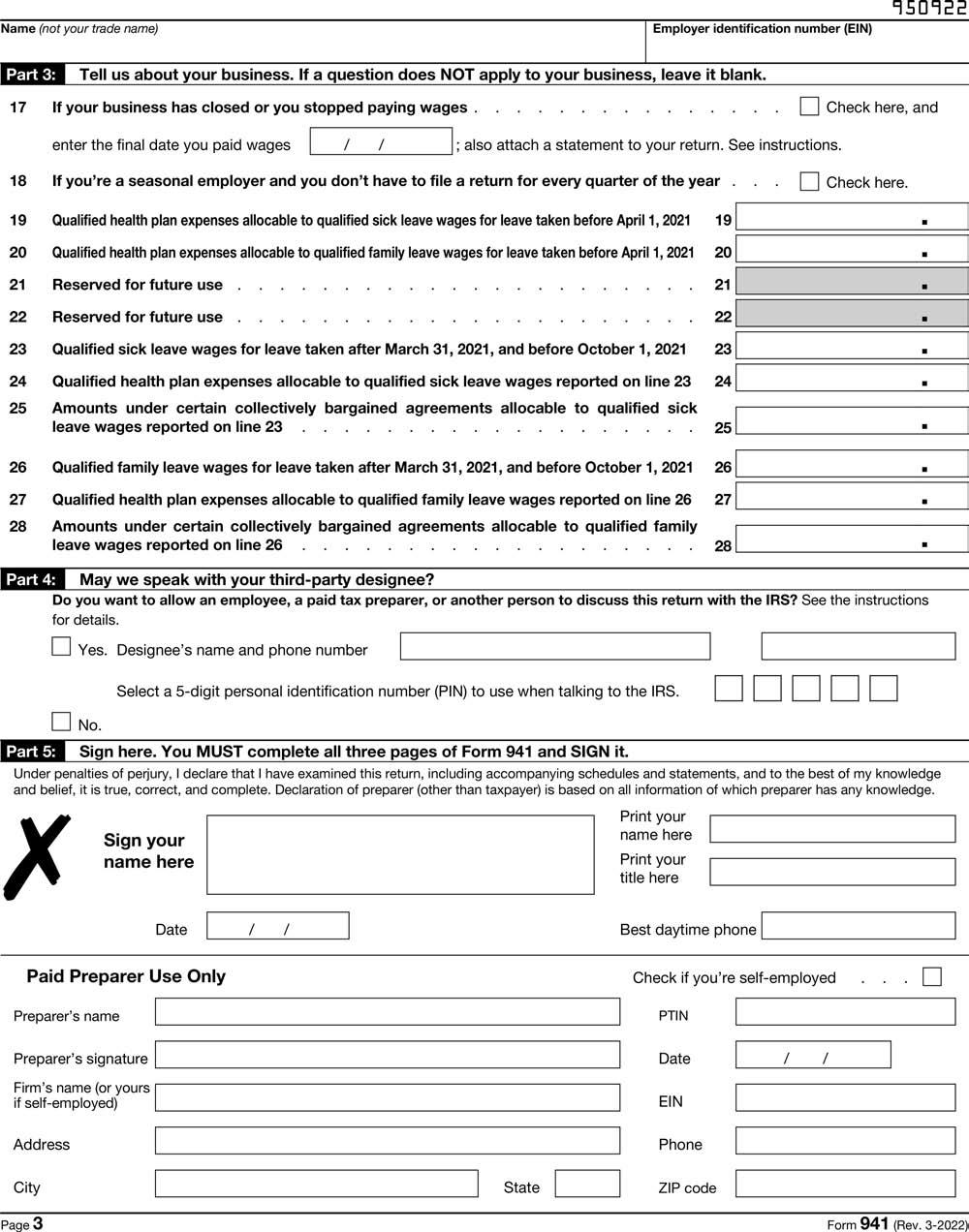

Using the information from P6-6A, complete the following Form 941 for the first quarter of 2022. The report was signed on April 15, 2022.

EIN: 78-7654398

Address: 23051 Old Redwood Highway, Sebastopol, California, 95482,

phone 707-555-5555

Number of employees: 7

Wages, tips, and other compensation paid during the first quarter of 2022: $244,798

Income tax withheld from employees: $48,000

Social Security tax withheld from employees: $15,177.48

Medicare tax withheld from employees: $3,549.57

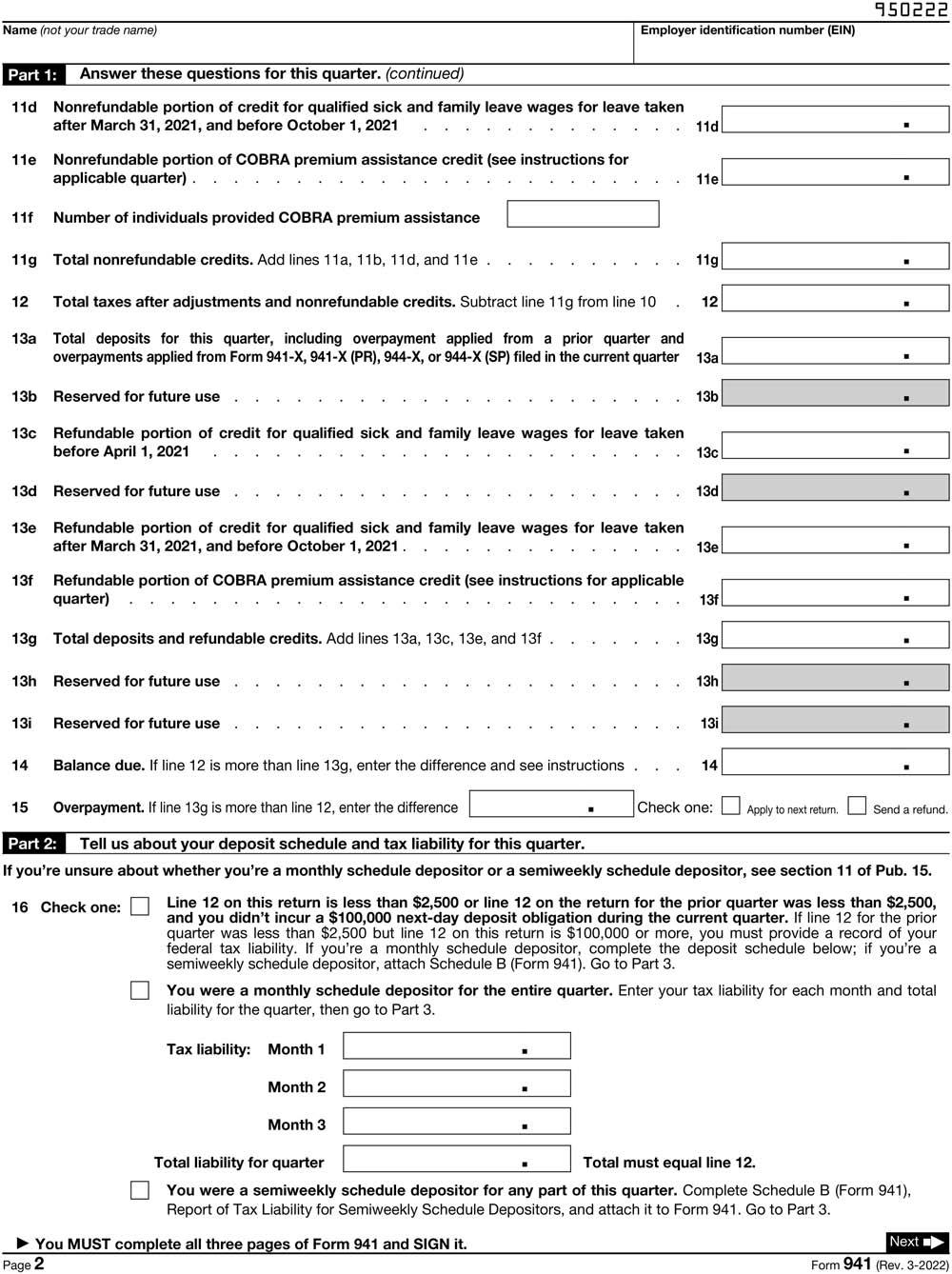

Monthly tax liability:

January $28,484.70

February 28,484.70

March 28,484.70

Transcribed Image Text:

Form 941 for 2022: Employer's QUARTERLY Federal Tax Return (Rev. March 2022) Department of the Treasury Internal Revenue Service Employer identification number (EIN) Name (not your trade name) Trade name (if any) Address 2 3 4 6 7 Foreign country name Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 8 9 Number 10 City 11a 11b Street Foreign province/county 5a Taxable social security wages*. 5a (i) Qualified sick leave wages* 5a (ii) Qualified family leave wages* 5b Taxable social security tips.. 5c Taxable Medicare wages & tips. 5d Taxable wages & tips subject to Additional Medicare Tax withholding 5e Total social security and Medicare taxes. Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d 5f Section 3121(q) Notice and Demand-Tax due on unreported tips (see instructions) State . Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1)... Wages, tips, and other compensation Federal income tax withheld from wages, tips, and other compensation Total taxes before adjustments. Add lines 3, 5e, and 5f If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 Current quarter's adjustment for fractions of cents 11c Reserved for future use I Suite or room number ■ ZIP code ■ Foreign postal code · ■ . x 0.124 = x 0.062 = x 0.062 = x 0.124 = x 0.029 = × 0.009 = Current quarter's adjustment for sick pay Current quarter's adjustments for tips and group-term life insurance ► You MUST complete all three pages of Form 941 and SIGN it. For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. . ■ . I 1: January, February, March 2: April, May, June 3: July, August, September 4: October, November, December Go to www.irs.gov/Form941 for instructions and the latest information. Report for this Quarter of 2022 (Check one.) 1 2 3 5e 5f 6 7 8 Total taxes after adjustments. Combine lines 6 through 9 Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11a Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021. 9 10 11b 950122 OMB No. 1545-0029 11c Check and go to line 6. *Include taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, on line 5a. Use lines 5a(i) and 5a(ii) only for taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021. Cat. No. 17001Z . . Next Form 941 (Rev. 3-2022)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

Given the information from P66A heres how you would complete Form 941 for the first quarter of 2022 The form displayed seems to be the correct version ...View the full answer

Answered By

Mamba Dedan

I am a computer scientist specializing in database management, OS, networking, and software development. I have a knack for database work, Operating systems, networking, and programming, I can give you the best solution on this without any hesitation. I have a knack in software development with key skills in UML diagrams, storyboarding, code development, software testing and implementation on several platforms.

4.90+

97+ Reviews

194+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Using the information from P6-6B, complete the following form 941 for the first quarter of 2022. The form was signed by the owner on April 11, 2022. EIN: 98-0050036 Address: 1021 Old Plainfield Road,...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

During the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees' salaries or wages and the amount of tips reported to...

-

Discuss the seven contemporary communication issues facing managers.

-

Rochester Electro Medical Inc. is a manufacturing company based in Tampa, Florida, that produces medical products. Management had the business objective of improving the safety of the workplace and...

-

5. LO.4 Ariannas personal residence has an adjusted basis of $230,000 and a fair market value of $210,000. Arianna converts the personal residence to rental property. What is Ariannas gain basis?...

-

Channel confl ict between manufacturers and retailers is likely to arise when manufacturers use ________________ websites.

-

The boom is intended to support two vertical loads F1 and F2. If the cable CB can sustain a maximum load Tmax before it fails, determine the critical loads if F1 = 2F2. Also, what is the magnitude of...

-

Intelligent Toys, Inc (ITI) is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly basis. The trial balance of ITI as at 28...

-

Using the information from P6-10B for Castor Corporation, complete Form W-3 that must accompany the companys Form W-2s. Castor Corporation is a 941 payer and is a private, for-profit company. No...

-

Using the information from P6-4A, compute the employers share of the taxes. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent...

-

Deposits in Leasing Many lessors require a security deposit in the form of a cash payment or other pledged collateral. Suppose Lambert requires Wildcat to pay a $500,000 security deposit at the...

-

2. Getting ready for Logarithms and Calculus! a. Fill in the chart and graph the function (I advise practicing on your scientific calculator and desmos. X f(x) = Inx 0 0.5 1 e 10...

-

JoJo Co. had the following balances and information for October. Beg. finished goods inventory = $30 Beg. work in process inventory = $5 Beg. raw materials inventory = $15 End. finished goods...

-

Subway sales have been declining since 2014. In the US, Subway has closed a number of stores due to over-expansion, outdated operations, and uninspiring menus. In Canada, Subway took a different...

-

Harvey Auto Parts purchased a new crane on September 1 for $35,000, paying $10,000 cash and signing a 7%, 12-month note for the remaining balance, interest to be paid at maturity. The crane is...

-

e4(k+1) Find the sum of the series. k = 1 8

-

Morton Manufacturing maintains a credit line with First Bank that allows the company to borrow up to $1 million. A covenant associated with the loan contract limits the companys dividends in any one...

-

Find the volume of the described solid S. A frustum of a right circular cone with height h, lower base radius R, and top radius r -r- --R

-

What is the difference between a facility-level cost and a unit-level cost?

-

How does the hierarchy of costs help managers allocate overhead costs?

-

Refer to the dialogue presented at the beginning of the chapter and the follow-up dialogue before Figure 3.7. Required: a. In the opening dialogue, why was the owner concerned about the product costs...

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App