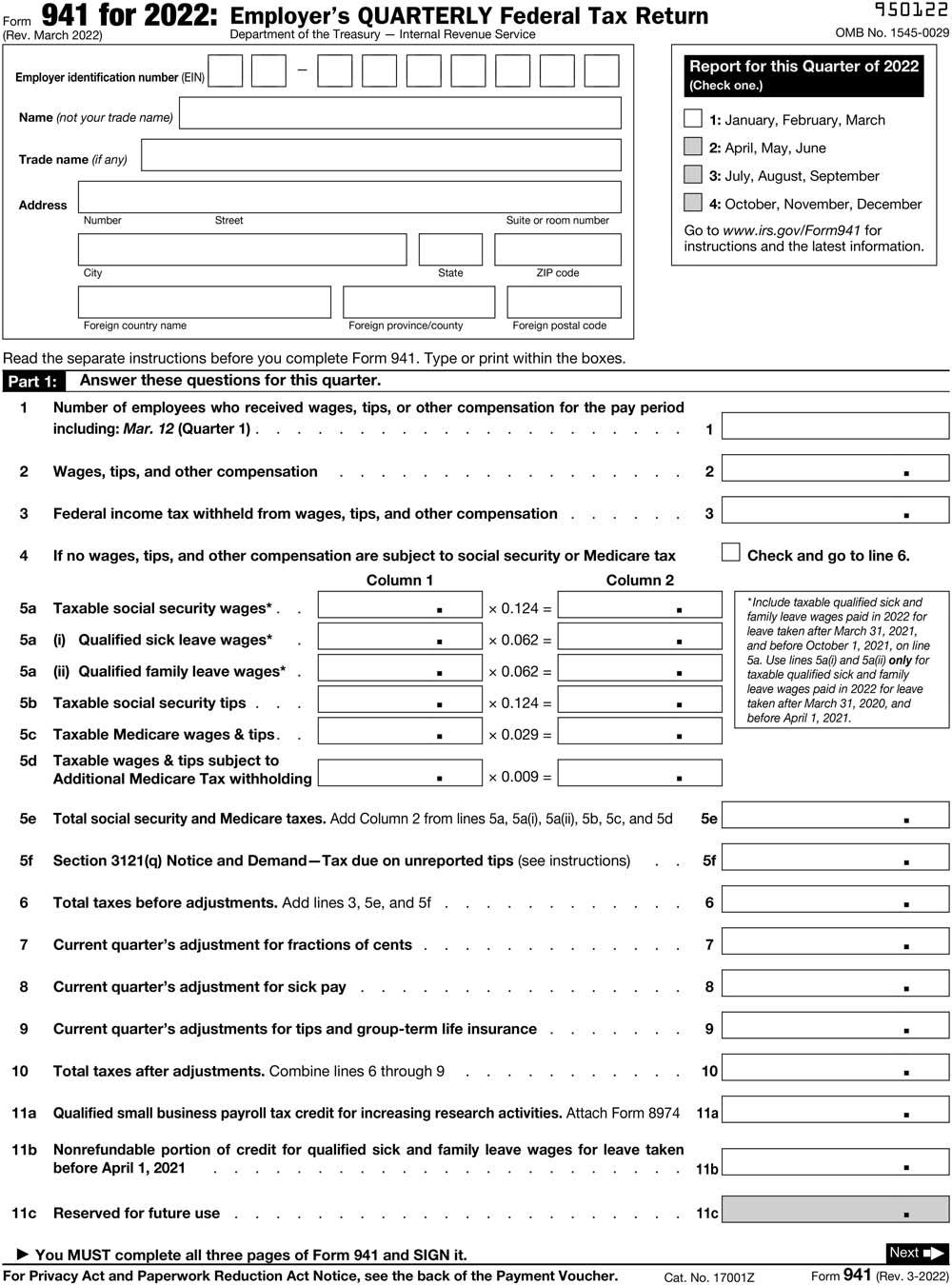

Using the information from P6-6B, complete the following form 941 for the first quarter of 2022. The

Question:

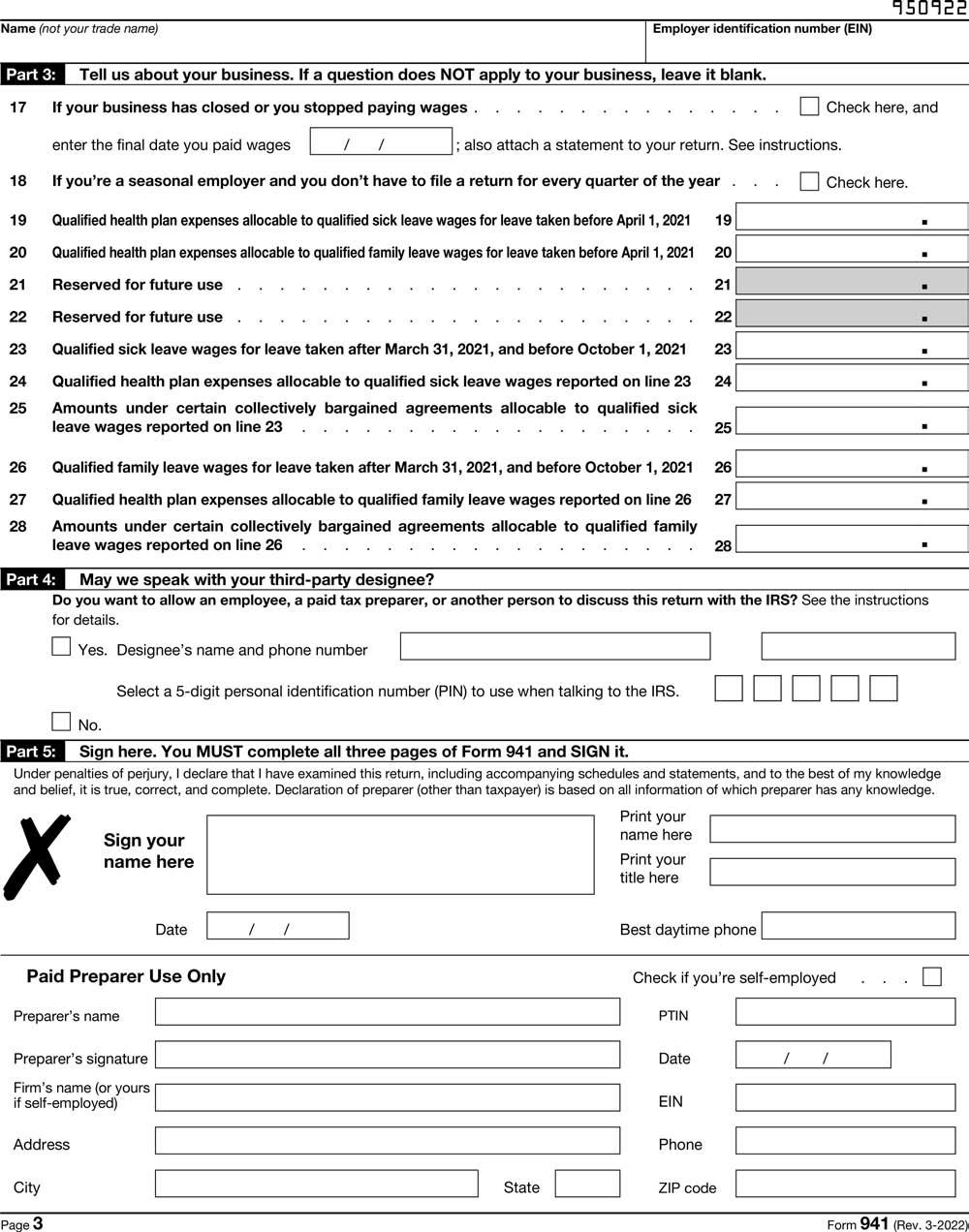

Using the information from P6-6B, complete the following form 941 for the first quarter of 2022. The form was signed by the owner on April 11, 2022.

EIN: 98-0050036

Address: 1021 Old Plainfield Road, Salina, California, 95670

Phone: 707-555-0303

Number of employees: 8

Wages, tips, and other compensation paid during the first quarter of 2022: $302,374

Social Security taxable wages: $280,000

Medicare taxable wages: $280,000

Income tax withheld: $51,000

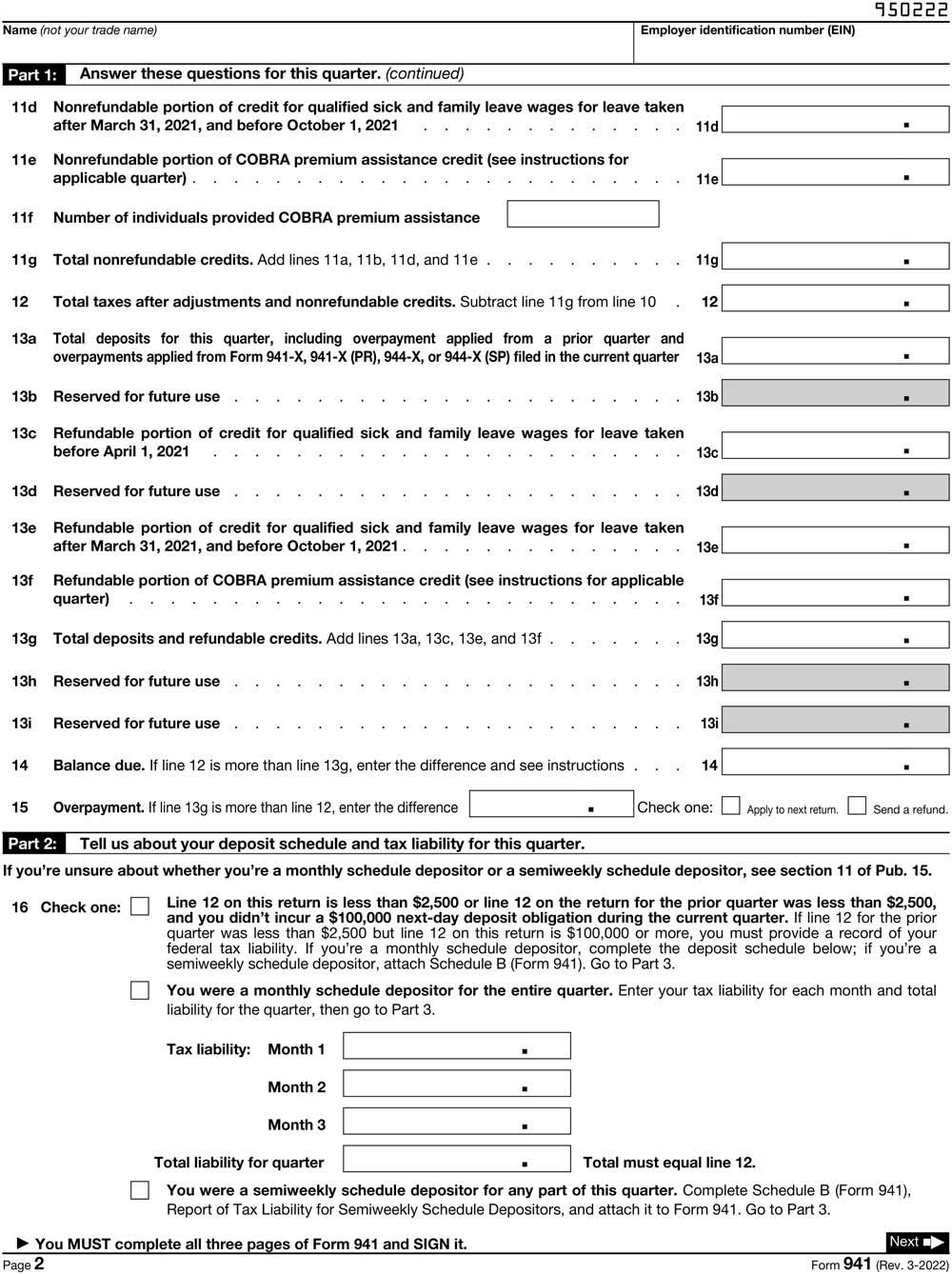

Monthly tax liability:

January $31,280.00

February 31,280.00

March 31,280.00

Transcribed Image Text:

Form 941 for 2022: Employer's QUARTERLY Federal Tax Return (Rev. March 2022) Department of the Treasury Internal Revenue Service Employer identification number (EIN) Name (not your trade name) Trade name (if any) Address 2 3 4 6 7 Foreign country name Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 8 9 Number 10 City 11a 11b Street Foreign province/county 5a Taxable social security wages*. 5a (i) Qualified sick leave wages* 5a (ii) Qualified family leave wages* 5b Taxable social security tips.. 5c Taxable Medicare wages & tips. 5d Taxable wages & tips subject to Additional Medicare Tax withholding 5e Total social security and Medicare taxes. Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d 5f Section 3121(q) Notice and Demand-Tax due on unreported tips (see instructions) State . Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1)... Wages, tips, and other compensation Federal income tax withheld from wages, tips, and other compensation Total taxes before adjustments. Add lines 3, 5e, and 5f If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 Current quarter's adjustment for fractions of cents 11c Reserved for future use I Suite or room number ■ ZIP code ■ Foreign postal code · ■ . x 0.124 = x 0.062 = x 0.062 = x 0.124 = x 0.029 = × 0.009 = Current quarter's adjustment for sick pay Current quarter's adjustments for tips and group-term life insurance ► You MUST complete all three pages of Form 941 and SIGN it. For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. . ■ . I 1: January, February, March 2: April, May, June 3: July, August, September 4: October, November, December Go to www.irs.gov/Form941 for instructions and the latest information. Report for this Quarter of 2022 (Check one.) 1 2 3 5e 5f 6 7 8 Total taxes after adjustments. Combine lines 6 through 9 Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11a Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021. 9 10 11b 950122 OMB No. 1545-0029 11c Check and go to line 6. *Include taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, on line 5a. Use lines 5a(i) and 5a(ii) only for taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021. Cat. No. 17001Z . . Next Form 941 (Rev. 3-2022)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

Based on the information provided here is the filledout Form 941 for the first quarter of 2022 Page 1 Employer identification number EIN 980050036 Nam...View the full answer

Answered By

Gaurav Samadhiya

My name is gaurav samadhiya. I have finished my schooling with good academic marks and i have many merhods to teacher the students. I can solve problems in such a manner that stuent can understand easily. I have done btech so i technically good person and i have qualified gate exam which is conducted by iit. Many ofgline classes are taken by me up to 12 standard.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Using the information from P6-6A, complete the following Form 941 for the first quarter of 2022. The report was signed on April 15, 2022. EIN: 78-7654398 Address: 23051 Old Redwood Highway,...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

During the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees' salaries or wages and the amount of tips reported to...

-

What are the concepts of traditional and contemporary organizational design? Will these designs be influenced differently by management and the environment?

-

A member of the volunteer fire department for Trenton, Ohio, decided to apply the control chart methodology he learned in his business statistics class to data collected by the fire department. He...

-

2. LO.3 Luciana, a nonshareholder, purchases a condominium from her employer for $85,000. The fair market value of the condominium is $120,000. What is Lucianas basis in the condominium and the...

-

Have you made an online purchase? If so, why do you think so many people who have access to the Internet are not also online buyers? If not, why are you reluctant to do so? Do you think that...

-

John has a 60% capital and profits inter- est in the JAS Partnership with a basis of $333,600, which includes his share of liabilities, when he decides to retire. Andrew and Stephen want to continue...

-

Income Statement and Balance Sheet Green Bay Corporation began business in July 2017 as a commercial fishing operation and a passenger service between islands. Shares of stock were issued to the...

-

Using the information from P6-10B for Castor Corporation, complete Form W-3 that must accompany the companys Form W-2s. Castor Corporation is a 941 payer and is a private, for-profit company. No...

-

Using the information from P6-4A, compute the employers share of the taxes. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent...

-

The year-end Trial Balance of Dido Ltd includes the ledger balances stated below. Dido had acquired a machine for 60,000 on 1 March 2010 and on 1 May 2010 sold for 14,000 a vehicle acquired on 1...

-

Carla Vista Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2025, the following balances relate to this plan Plan assets $489,900 Projected benefit obligation 616,700...

-

Question 2 of 8 Shirts were purchased for $12.50 each and were marked up by $18.75. During Christmas, they were discounted by $6.85 per shirt. a. What was the rate of markdown? % Round to two decimal...

-

The cost versus quality decision is one that only few companies get right. What is the cost of quality? It is very high for some companies such as Ford and Bridgestone/Firestone, whose reputations...

-

Find the absolute maximum and absolute minimum values of the function f(x) (x-2)(x-5)+7 = on each of the indicated intervals. Enter 'NONE' for any absolute extrema that does not exist. (A) Interval =...

-

4. Roll one 10-sided die 12 times. The probability of getting exactly 4 eights in those 12 rolls is given by (a) 10 9 4 10 10 (b) HA 9 -HAA (c) 1 (d) 9 (c) 10 9 () 10

-

Excerpts from Crozier Industries financial records as of December 31, 2018, follow: The amounts shown do not include any tax effects. Croziers tax rate is 35 percent. Assume that all items are...

-

The polar coordinates of a point are given. Find the rectangular coordinates of the point. (-1, - /3)

-

Calculating Plantwide Predetermined Overhead Rate. Manufacturing overhead costs totaling $5,000,000 are expected for this coming year. The company also expects to use 100,000 direct labor hours and...

-

Manufacturing overhead costs totaling $500,000 are expected for this coming year$200,000 in the Assembly department and $300,000 in the Finishing department. The Assembly department expects to use...

-

Describe the four categories related to the costs of quality. How might the allocation of quality costs to these four categories help managers?

-

Read the following and then answer the questions below:September 12: A Brisbane business offers by letter to sell 500 tyres to a New Zealand company. The Brisbane company does not specify a method of...

-

Fred returns home from work one day to discover his house surrounded by police. His wife is being held hostage and threatened by her captor. Fred pleads with the police to rescue her and offers...

-

Would like you to revisit one of these. Consideration must be clear and measurable.if you can't measure it then how can you show it has / has not been done?How can you sue someone for breach of...

Study smarter with the SolutionInn App