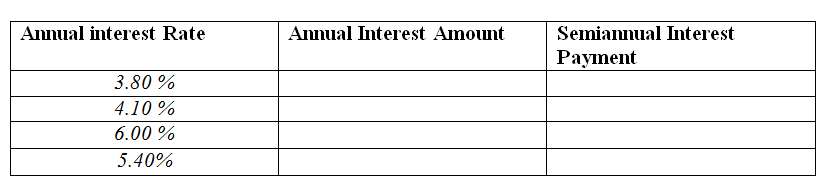

Calculate the annual interest and the semiannual interest payment for the following corporate bond issues with a

Question:

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Annual interest Rate Semiannual Interest Annual Interest Amount Payment 3.80 % 4.10 % 6.00 % 5.40%

Step by Step Answer:

Annual Interest Rate 380 ...View the full answer

Personal Finance

ISBN: 978-1259720680

12th edition

Authors: Jack R. Kapoor, Les R. Dlabay, Robert J. Hughes, Melissa Hart

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

On January 1, 2020, Harrington Corporation sold $425,000 of 15-year, 11% bonds. The bonds sold for $395,000 and pay interest semiannually on June 30 and December 31. Required: 1. Prepare the journal...

-

On December 31, 2009, Harrington Corporation sold $100,000 of 10-year, 9 percent bonds. The bonds sold for $96,000 and pay interest semiannually on June 30 and December 31. Required: 1. Prepare the...

-

Assume that the annual interest rate on a six-month U.S. Treasury bill is 5%, and use the data presented in Figure to answer the following: a. Calculate the annual interest rate on six-month bills in...

-

Jinny Buffett recently retired as a flight attendant and is interested in opening a fitness center and health spa exclusively for women in Grand Cayman, where she resides. After careful study, she is...

-

Review each of the following items that were noted by the CFO after the unadjusted trial balance was prepared and make adjusting and reclassifying entries as necessary. Do not assume that all items...

-

Which part of the AIDA model does personal selling best achieve?

-

The following balances were extracted from the accounts of the Blue Moon Hotel at 31st December 2005. Prepar the Income Statement in accordance with the Uniform System of Hotel Accounting introduced...

-

Compute the cost of capital for the firm for the following: a. Currently bonds with a similar credit rating and maturity as the firms outstanding debt are selling to yield 8 percent while the...

-

Sabbie Corporation, incorporated in 2018 had the following data. 2018 2019 Accounting income before tax: $ 210,000 $270,000 Items included in arriving at income before tax: Golf dues 8,000 9,000...

-

Gloria and Deloria, CPAs, have recently started their public accounting firm and intend to provide attestation and a variety of consulting services for their clients, which are all nonpublic. Both...

-

Jackson Metals, Inc., issued a $1,000 convertible corporate bond. Each bond is convertible to 25 shares of the firms common stock. a. What price must the common stock reach before investors would...

-

Jean Miller purchased a $1,000 corporate bond for $860. The bond pays 4 percent annual interest. Three years later, she sold the bond for $980. Calculate the total return for Ms. Millers bond...

-

What makes an organization's information system important? Explain.

-

Arrow Company processes a food seasoning powder through its Compounding and Packaging departments. In the Compounding Department, direct materials are added at the beginning of the process, and...

-

The 2017 financial statements of LVMH Moet Hennessey Louis Vuitton S.A. are presented in Appendix C at the end of this book. LVMH is a Paris-based holding company and one of the world's largest and...

-

Repeat Problem 10.E1, except design a packed column using 1-in. metal Pall rings. Do the calculations at the top of the column. Approximate HETP for ethanol-water is \(0.366 \mathrm{~m}\). At...

-

We are separating an ethanol-water mixture in a column operating at atmospheric pressure with a total condenser and a partial reboiler. Constant molal overflow (CMO) can be assumed, and reflux is a...

-

Corporate Social Responsibility Problem The Global Reporting Initiative (GRI) is a networkbased organization that has pioneered the development of the world's most widely used sustainability...

-

Evaluate the following limits. lim x3 v-1--5 V-3 V

-

Government is advised to tax goods whose demand curves are inelastic if the goal is to raise tax revenues. If the goal is to discourage consumption, then it ought to tax goods whose demand curves are...

-

Review figures and record in writing an investment plan to fund retirement, presumably one of your own long-term goals.

-

Now that you have read the chapter on investment fundamentals, what do you recommend to Shavenellyee and Sarena on the subject regarding? 1. Portfolio diversification for Shavenellyee? 2. Dollar-cost...

-

1. Why should people invest? Give three reasons each for college students, young college graduates in their 20s, couples with young children, and people in their 50s. 2. Review Figure, Long-Term...

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App