Cobalt, a calendar-year S corporation, was incorporated in 2010. The company had the following taxable income and

Question:

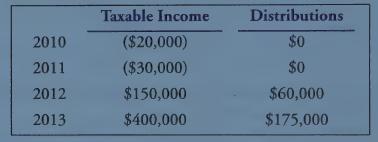

Cobalt, a calendar-year S corporation, was incorporated in 2010. The company had the following taxable income and distributions each year:

Cobalt has a single shareholder. His original basis in the stock was $150,000. What is the shareholder’s basis at the end of 2013?

a. $150,000.

b. $250,000.

c. $415,000.

d. $650,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Planning

ISBN: 9781936602094

3rd Edition

Authors: Michael A Dalton, Joseph Gillice

Question Posted: