Calculating taxable income for a married couple filing jointly. Freya and Sebastian Hunter are married and have

Question:

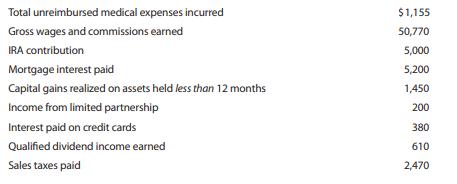

Calculating taxable income for a married couple filing jointly. Freya and Sebastian Hunter are married and have one child. Sebastian is putting together some figures so he can prepare the Hunters’ joint 2018 tax return. So far, he’s been able to determine the following concerning income and possible deductions:

Given this information, determine the amount of the available itemized deductions. How much taxable income will the Hunters have in 2018? (Note: Assume that Sebastian is not covered by a pension plan where he works, his child qualifies for the child tax credit, and the standard deduction of $24,000 for married filing jointly applies.) LO1

Step by Step Answer:

PFIN

ISBN: 9780357033616,9780357033692

7th Edition

Authors: Randall Billingsley , Lawrence J. Gitman , Michael D. Joehnk