Choosing and preparing an individual tax form. Liam McKenzie is single, graduated from college in 2018 and

Question:

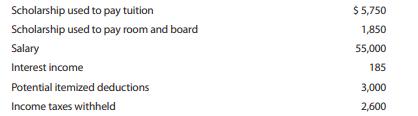

Choosing and preparing an individual tax form. Liam McKenzie is single, graduated from college in 2018 and began work as a systems analyst in July of that year. He is preparing to file his income tax return for 2018 and has collected the financial information shown below for that calendar year A blank Form 1040 and Schedule 1 may be obtained at www.IRS.gov.

a. Prepare Liam’s 2018 tax return, using a $12,000 standard deduction and the tax rates given in Exhibit 3.3.

b. Prepare Liam’s 2018 tax return using the data in part a along with the following information:

IRA contribution $5,000 Cash dividends received 150? LO1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

PFIN

ISBN: 9780357033616,9780357033692

7th Edition

Authors: Randall Billingsley , Lawrence J. Gitman , Michael D. Joehnk

Question Posted: