Question: Repeat the VMI example in section 14.2.3 assuming this time that the tax rate to be paid by Linner and the supplier is not zero,

Repeat the VMI example in section 14.2.3 assuming this time that the tax rate to be paid by Linner and the supplier is not zero, but 20 percent.

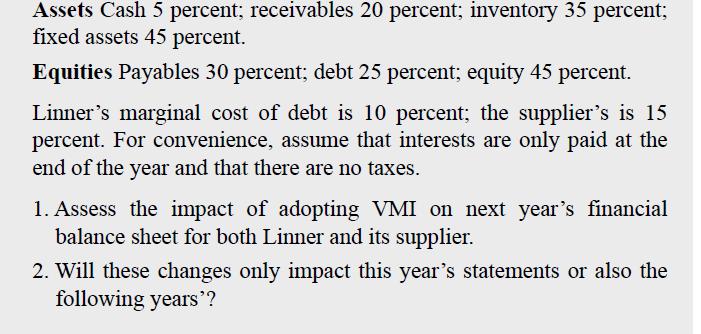

Linner Inc. The COO of Linner Inc. has proposed a VMI contract to its main raw material supplier. Under the VMI contract, set to go into effect at the beginning of next year, 60 percent of Linner's current raw materials which account for 50 percent of total inventory-will become the property of the supplier. The current balance sheet is as follows: (data as percentage of assets, which is $10 million).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts