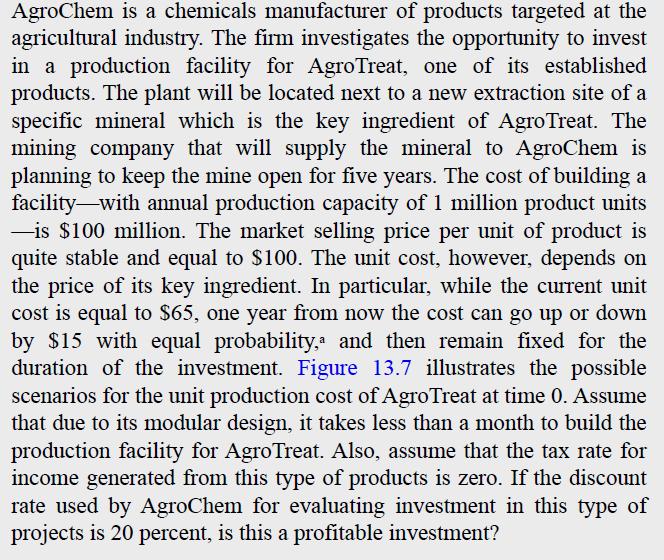

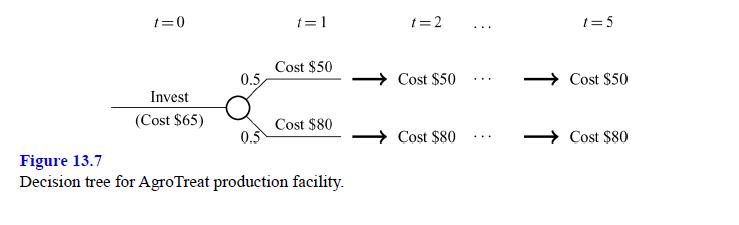

In the AgroChem example in section 13.5.1 we have assumed that a discount rate of 20 percent

Question:

In the AgroChem example in section 13.5.1 we have assumed that a discount rate of 20 percent is applicable throughout the investment’s duration. Now, assume that if the company delays its decision by one year (i.e., when all cost uncertainty has been resolved), then the applicable discount rate if the low cost scenario materializes is 10 percent. What would be in this case the value of AgroChem’s option to delay its investment decision by one year?

In problems 2 to 5, please use the logic of options through decision trees and classical discounted cash flows techniques—rather than a formal real options valuation approach—to approximate the value of options available to the corresponding investments.

Step by Step Answer:

Practical Finance For Operations And Supply Chain Management

ISBN: 9780262043595

1st Edition

Authors: Alejandro Serrano, Spyros D. Lekkakos, James B. Rice