Eurowide Corporation has two foreign affiliates: A is in a low-tax country (30 percent tax rate) and

Question:

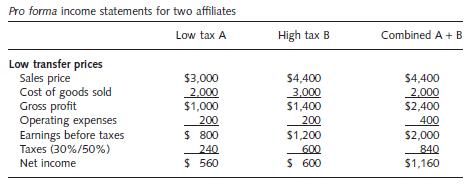

Eurowide Corporation has two foreign affiliates: A is in a low-tax country (30 percent tax rate) and B is in a high-tax country (50 percent tax rate). Affiliate A produces partially finished products and sells them to affiliate B, where the production process is completed.

The pro forma income statements of these two affiliates are shown in the following table.

Assume that the company increases its transfer price from \($3,000\) to \($3,600.\) Determine the tax effect of this high transfer price on the company’s consolidated net income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim

Question Posted: