A multinational company has a subsidiary in country A that produces auto parts and sells them to

Question:

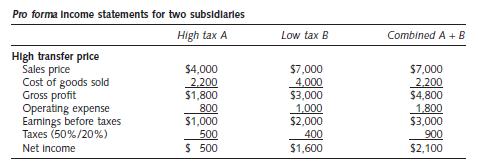

A multinational company has a subsidiary in country A that produces auto parts and sells them to another subsidiary in country B, where the production process is completed.

Country A has a tax rate of 50 percent, while country B has a tax rate of 20 percent. The income statements of these two subsidiaries are shown in the following table:

Assume that the multinational company reduces its transfer price from \($4,000\) to \($3,200.

Determine\) the tax effect of this low transfer price on the company’s consolidated net income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim

Question Posted: