Financial derivatives forwards, futures, options, and swaps are contracts whose values are linked to or

Question:

Financial derivatives – forwards, futures, options, and swaps – are contracts whose values are linked to or derived from values of underlying assets, such as securities, commodities, and currencies.

There are two types of markets for financial derivatives: organized exchanges and over-the-counter (OTC) markets. Organized exchanges such as the Chicago Mercantile Exchange are regulated by governments, while OTC markets such as banks are unregulated.

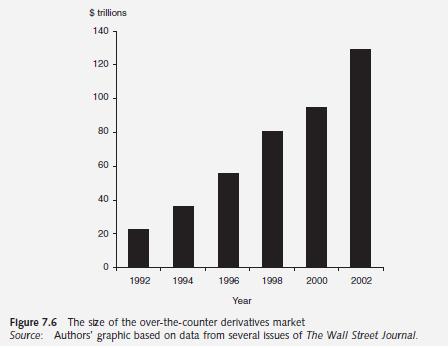

Derivatives are used by corporations, banks, and investors to reduce a variety of risks, such as exposure to currency movements (hedging), or to make leveraged bets on the market direction of these instruments (speculation). Derivatives markets have shown extraordinary growth over the past few years. For example, the size of the global OTC derivatives markets increased from \($21\) trillion of contracts in 1992 to \($130\) trillion of contracts in 2002 (see figure 7.6); the amount of outstanding exchange traded derivatives exceeded \($20\) trillion in 2002. In addition, recent years have witnessed numerous accounts of derivative-related losses on the part of established and reputable firms.

Large losses associated with the use of derivatives include the US oil subsidiary of Metallgesellschaft

(\($1\) billion), Daiwa Bank of Japan (\($1\) billion), Kashima Oil of Japan (\($1.5\) billion), Showa Shell of Japan (\($1.5\) billion), Sumitomo Corp. of Japan (\($1.8\) billion), Orange County, California (\($1.7\) billion), Barings of the UK (\($1.3\) billion), Long-Term Capital Management of the USA (\($3\) billion), and Allied Irish Bank of the USA/UK (\($691\) million). All these derivativerelated losses have occurred since 1994. The recent rapid growth of derivatives markets and large derivative-related losses have triggered concern and even alarm over the dangers posed by the widespread use of derivatives.

On February 27, 1995, speculative trading by a 28-year-old trader contributed to bringing down Barings PLC, the oldest merchant bank in the UK. In the days that followed, investigators found that the bank’s total losses from 1992 to 1995 exceeded \($1\) billion, a sum larger than its entire \($860\) million in equity capital. Barings had hired the British trader Nicholas Leeson from Bankers Trust in 1992 to build global fixed-income securities in Singapore. The cause of these losses was a breakdown in Barings’ risk management system that allowed Leeson to accumulate and conceal an unhedged \($27\) billion position in various exchange-traded futures and options contracts.

What lessons do these losses and growth hold for policy-makers? Do they indicate the need for more strict government supervision of derivatives markets or for new laws and regulations to limit the use of these instruments? Apparently, US regulatory authorities think that derivatives pose inherent dangers. In the first half of 1997, Congress had introduced some half-dozen bills designed to ban or limit derivatives. In January 1997, the Securities and Exchange Commission (SEC) adopted a regulation requiring companies to present estimates of losses they could suffer from financial instruments. The Financial Accounting Standard Board (FASB)

adopted its Statement 133, Accounting for Derivative Instruments and Hedging Activities, in 1998. FASB 133 requires companies to report the fair market value of their derivatives on their balance sheets and to include some derivatives gains or losses on their income statements. The legal status of derivatives was further cast into doubt in 1998, when the Commodity Futures Trading Commission (CFTC) suggested that it had the right to regulate trading in these instruments under the Commodity Futures Trading Commission Act of 1974. Especially big targets of these reforms are privately negotiated contracts through OTC markets.

Since 1997, several hundred letters from big companies, accountants, and even Federal Reserve Chairman Alan Greenspan have laid out the potential damage of these derivatives regulations.

In February 2000, a White House panel on OTC derivatives urged Congress to exempt the \($80\) trillion derivatives market from government regulation. Nevertheless, standard-setters around the world – the USA, the UK, Canada, other industrial countries, and the International Accounting Standards Committee – have recently proposed and/or issued their standards to increase disclosure of off-balance-sheet derivatives transactions.

Case Questions 1 What are the major classes of risk in derivatives trading?

2 What is the potential damage of government derivative rules on derivatives users?

3 Had there been any warning signs that should have alerted the management of Barings to problems with its Singapore futures subsidiary?

4 What lessons for the management of financial institutions to be learned from the failure of Barings?

5 The website of the Securities and Exchange Commission (SEC), www.sec.gov, and the website of the Financial Accounting Standards Board (FASB), www.fasb.org, describe standard practices for financial reporting by companies in the USA. Access the above websites to learn proposed accounting standards and the status regarding reactions to these proposed standards.

Step by Step Answer:

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim