Lofting Snodbury is considering investing in a new boring machine. It costs $380,000 and is expected to

Question:

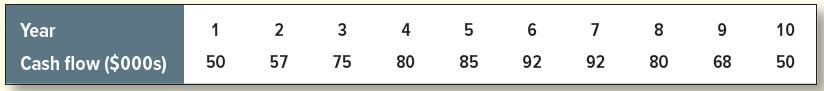

Lofting Snodbury is considering investing in a new boring machine. It costs $380,000 and is expected to produce the following cash flows:

If the cost of capital is 12%, what is the machine’s NPV?

Transcribed Image Text:

Year Cash flow ($000s) 1 50 2 57 3 75 4 80 5 85 6 92 7 92 8 80 9 68 10 50

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (8 reviews)

10 NPV t0 Ct 112 NPV 380000 50000 ...View the full answer

Answered By

Munibah Munir

I've done MS specialization in finance’s have command on accounting and financial management. Forecasting and Financial Statement Analysis is basic field of my specialization. On many firms I have done real base projects in financial management field special forecasting. I have served more than 500 Clients for more than 800 business projects, and I have got a very high repute in providing highly professional and quality services.I have capability of performing extra-ordinarily well in limited time and at reasonable fee. My clients are guaranteed full satisfaction and I make things easy for them. I am capable of handling complex issues in the mentioned areas and never let my clients down.

4.60+

467+ Reviews

648+ Question Solved

Related Book For

Principles Of Corporate Finance

ISBN: 9781265074159

14th International Edition

Authors: Richard Brealey

Question Posted:

Students also viewed these Business questions

-

A plant manager is considering investing in a new $30,000 machine. Use of the new machine is expected to generate a cash flow of about $8,000 per year for each of the next five years. However, the...

-

A company is considering investing in a new machine that requires a cash payment of $15,982 today. The machine will generate annual cash flows of $7,000 for the next three years. What is the internal...

-

Steele Electronics is considering investing in a new component that requires a $ 100,000 investment in new capital equipment, as well as additional net working capital. The investment is expected to...

-

4 pts A lottery winner will receive $0.5 mulhon at the end of each of the next se yearn. What is the future value of her winnings at the time of her final payment, given that the interest rate is 6%...

-

1. Which of the following is not a warning sign of potential liquidity problems? a. Declines in working capital and daily cash flows b. Increases in accounts receivable and longer collection periods...

-

A leader attends a conference and returns with excitement about a novel way to manage patient education and hospital discharge planning. The leader calls everyone into the conference room to share...

-

P2-7 Partial income statement with discontinued operations Paveen Corporation acquired a 30 percent interest in Cang Corporation at book value on January 1, 2014. Information for 2016 is given below:...

-

(Liberatore and Miller, 1985) A manufacturing facility uses two production lines to produce three products over the next 6 months. Backlogged demand is not allowed. However, a product may be...

-

emaining Time: 1 hour, 52 minutes 52 seconds Question Completion Status Moving to the next question prevents changes to this answer Question 11 2 Capable Inc. expects to sell 35,000 athletic forms...

-

You have just been hired by Internal Business Machines Corporation (IBM) in their capital budgeting division. Your first assignment is to determine the free cash flows and NPV of a proposed new type...

-

A project produces a cash flow of $432 in year 1, $137 in year 2, and $797 in year 3. If the cost of capital is 15%, what is the projects PV? If the project requires an investment of $1,200, what is...

-

a. If the present value of $139 is $125, what is the discount factor? b. If that $139 is received in year 5, what is the interest rate?

-

Consider the following set of dependent and independent variables. These data can also be found in the Excel file Prob 151.xlsx. y 10 11 15 15 20 24 27 32 x1 2 5 5 9 7 11 16 20 x2 16 10 13 10 2 8 7 4...

-

Pomerantz in Chapter 8 discussed the expectation that the years leading up to 2030 Group of answer choices would be years of accelerating progress, a trend derailed by war, pandemic, economic...

-

A Mississippi chicken processing plant fired most of its remaining workers after nearly 100 accused of immigration violations were arrested last week, witnesses said, an indication that the crackdown...

-

You have added 15 songs to a Spotify playlist. You have 3 classic rock songs, 7 pop songs, and 5 country songs. You can play 4 songs on your walk to school. What is the probability that you hear 2...

-

a b Solve a) (725.25)10=(?)2=(?)16 b) (111100111110001)2= (?) 8 = (?) 16 Build the equation Y=AB+ CD + E to realize using a) NAND Gates b) NOR Gates Construct and describe Full Adder with neat logic...

-

With such a high base rate, you are confident about the chance of hiring and have posted the job ad based on a prior job analysis. Listed below are the final applicants and their profile of four key...

-

Is the following statement always, never, or sometimes valid? Explain your reasoning: A thermodynamic process is completely defined by the initial and final states of the system.

-

What is the maximum volume of 0.25 M sodium hypochlorite solution (NaOCl, laundry bleach) that can be prepared by dilution of 1.00 L of 0.80 M NaOCl?

-

Explain why accounting income generally differs from a firm's cash inflows.

-

Will the following actions increase or decrease the firm's cash balance? a. The firm sells some goods from inventory. b. The firm sells some machinery to a bank and leases it back for a period of 20...

-

Butterfly Tractors had $14 million in sales last year. Cost of goods sold was $8 million, depreciation expense was $2 million, interest payment on outstanding debt was $1 million, and the firm's tax...

-

A family has a $117,443, 25-year mortgage at 5.4% compounded monthly. (A) Find the monthly payment and the total interest paid. (B) Suppose the family decides to add an extra $100 to its mortgage...

-

Comparing the actual and planned cost of a consulting engagement completed by an engineering firm such as Allied Engineering.

-

What is the NPV of a project that costs $34,000 today and is expected to generate annual cash inflows of $11,000 for the next 7 years, followed by a final inflow of $14,000 in year 8. Cost of capital...

Study smarter with the SolutionInn App