Projects 1 and 2 have similar outlays, although the patterns of future cash flows are different. The

Question:

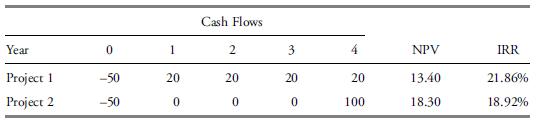

Projects 1 and 2 have similar outlays, although the patterns of future cash flows are different. The cash flows as well as the NPV and IRR for the two projects are shown below. For both projects, the required rate of return is 10%.

The two projects are mutually exclusive. What is the appropriate investment decision?

A. Invest in both projects.

B. Invest in Project 1 because it has the higher IRR.

C. Invest in Project 2 because it has the higher NPV.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan

Question Posted: