Take another look at the valuations of Rio in Tables 19.1 and 19.2. Now use the live

Question:

Take another look at the valuations of Rio in Tables 19.1 and 19.2. Now use the live spreadsheets in Connect to show how Rio?s value depends on:

a. The forecasted long-term growth rate.

b. The required amounts of investment in fixed assets and working capital.

c. The opportunity cost of capital. (Note: You can also vary the opportunity cost of capital in Table 19.1.)

d. Profitability?that is, cost of goods sold as a percentage of sales.

e. The assumed amount of debt financing.

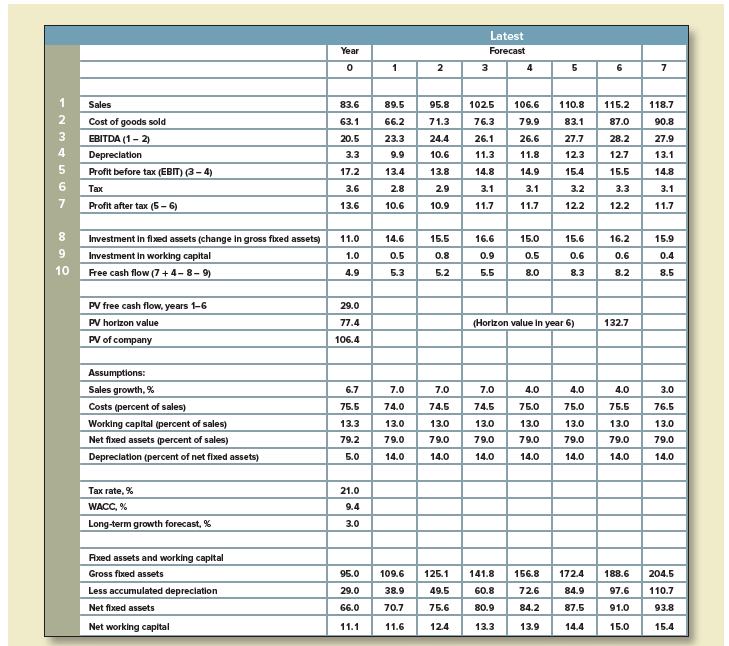

Table 19.1

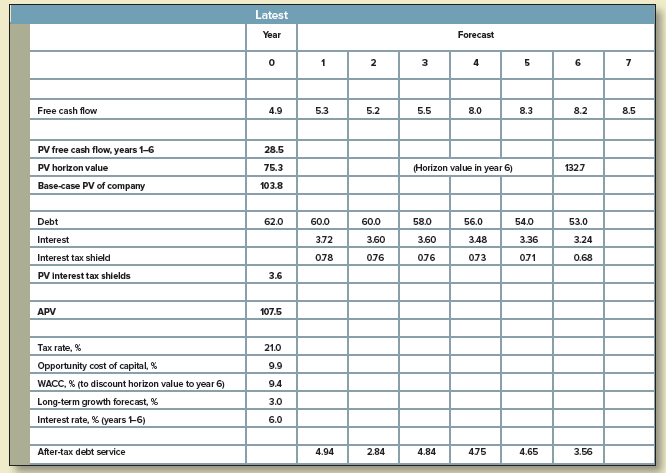

Table 19.2

Latest Year Forecast 2 4 Б 95.8 118.7 Sales 83.6 89.5 102.5 106.6 110.8 115.2 2 Cost of goods sold 63.1 66.2 71.3 76.3 79.9 83.1 87.0 90.8 3 EBITDA (1- 2) 24.4 20.5 23.3 26.1 26.6 27.7 28.2 27.9 4 10.6 Depreclation 3.3 9.9 11.3 11.8 12.3 12.7 13.1 Profit before tax (EBIT) (3-4) 13.8 17.2 13.4 14.8 14.9 15.4 15.5 14.8 3.2 Тах 3.6 2.8 2.9 3.1 3.1 3.3 3.1 Profit after tax (5– 6) 10.9 13.6 10.6 11.7 11.7 12.2 12.2 11.7 Investment in fl ed assets (change in gross fixed assets) 16.6 11.0 14.6 15.5 15.0 15.6 16.2 15.9 Investment in working capital 1.0 0.5 0.8 0.9 0.5 0.6 0.6 0.4 10 Free cash flow (7+ 4-8-9) 4.9 Б.3 Б.2 Б.5 8.0 8.3 8.2 8.5 PV free cash flow, years 1-6 29.0 77.4 (Horizon value in year 6) PV hortzon value 132.7 PV of company 106.4 Assumptions: Sales growth, % Costs (percent of sales) Working capital (percent of sales) 6.7 7.0 7.0 7.0 4.0 4.0 4.0 3.0 74.5 75.5 74.0 74.5 75.0 75.0 75.5 76.5 13.3 13.0 13.0 13.0 13.0 13.0 13.0 13.0 79.0 79.0 Net fixed assets (percent of sales) 79.2 79.0 79.0 79.0 79.0 79.0 Depreclation (percent of net fixed assets) 14.0 14.0 14.0 Б.О 14.0 14.0 14.0 14.0 Тах rate, % 21.0 WACC, % 9.4 Long-term growth forecast, % 3.0 Axed assets and working capital 109.6 125.1 141.8 204.5 Gross fixed assets 95.0 156.8 172.4 188.6 Less accumulated depreciation 29.0 38.9 49.5 60.8 72.6 84.9 97.6 110.7 75.6 84.2 93.8 Net fixed assets 66.0 70.7 80.9 87.5 91.0 Net working capital 11.1 11.6 12.4 13.3 13.9 14.4 15.0 15.4 Latest Year Forecast 2 4 Free cash flow 4.9 Б.3 5.2 Б.5 8.0 8.3 8.2 8.5 PV free cash flow, years 1-6 28.5 PV hortzon value 75.3 (Horizon value in year 6) 1327 Base-case PV of company 103.8 Debt 62.0 60.0 60.0 58.0 56.0 54.0 53.0 Interest 3.72 3.60 3.60 3.48 3.36 3.24 Interest tax shield 078 076 076 073 071 0.68 PV Interest tax shields 3.6 APV 107.5 Tax rate, % 21.0 Opportunity cost of capital, % 9.9 WACC, % (to discount horizon value to year 6) 9.4 Long-term growth forecast, % 3.0 Interest rate, % (years 1-6) 6.0 After-tax debt service 4.94 2.84 4.84 475 4.65 3.56

Step by Step Answer:

a The forecast ed long term growth rate impacts Rio s value by impacting the free cash flow availabl...View the full answer

Principles of Corporate Finance

ISBN: 978-1260013900

13th edition

Authors: Richard Brealey, Stewart Myers, Franklin Allen

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Take another look at this chapters Consider This box. What might be some reasons men seem to be falling behind in todays world? If this is true, why is it that women are still so poorly represented...

-

Take another look at investment opportunity (d) in Practice Question 7. Suppose a bank offers Norman a $600,000 personal loan at 8 percent. (Norman is a long-time customer of the bank and has an...

-

Take another look at Figure 20.5 (Mergents research report for The Coca-Cola Company). Based on the research provided by Mergents, would you buy stock in Coca-Cola? Justify your decision by providing...

-

Problem 10 The Solow Growth Model is an exogenous model of economic growth that analyzes changes in the level of output in an economy over time as a result of changes in the population growth rate,...

-

Cerebrosides are found in the brain and in the myelin sheath of nerve tissue. The structure of the cerebroside phrenosine is (a) What hexose is formed on hydrolysis of the glycoside bond of...

-

Sources and Use s Here are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash, and the amount:...

-

Identify the types of adjustments and their purpose.

-

Sarah Stoner sells handmade jewelry that she designs herself. The items arent expensive, and she has a loyal following in her town and the surrounding area. Sarah incurred the following unit costs to...

-

Question : 8 E hoa 5 Al-Saada Company sells one product at a selling price of 15 dinars per unit. If you know that the company's sales amounted to 300,000 dinars and that its net operating income...

-

During the month of June, Bon Voyage Travel recorded the following transactions: 1. Owners invested $25,000 in cash to start the business. They received common stock. 2. The month's rent of $500 was...

-

On February 29, 2019, when PDQ Computers announced bankruptcy, its share price fell from $3.00 to $.50 per share. There were 10 million shares outstanding. Does that imply bankruptcy costs of 10 ...

-

Check out the delayed quotes for Amazon options for different exercise prices and maturities. Take the mean of the bid and ask prices. a. Confirm that higher exercise prices mean lower call prices...

-

Fill in the blank field in this text: Specifying degrees with the Rotate tool, you must type the number when Revit does not display the number you want; the increments shown on-screen are set in the...

-

The following accounts appear in the ledger of Sheridan Ltd. after the books are closed at December 31 ( in thousands). Share Capital-Ordinary, no par, 1 stated value, 400,000 shares authorized;...

-

1. Let f(x) 223-9x2. (a) Find all critical points for f(x).

-

Sadie's ski shop sells ski and boots. Skis are sold for $300 per pair and have associated Variable Costs of $150 per pair. Boots are sold for $200 per pair with an associated Variable Expense of $65...

-

How do you apply what is learned in the Science of Branding 1 5 - 1 , Key Insights Regarding Global Brand Strategies Based on Research Findings to improve on the brand?

-

CASH MANAGEMENT Dr. Umburgh noticed that the $100.00 check made to Trenton Medical Supplies has not cleared for four months. What type of check is the outstanding check referred to as? a. Stale-dated...

-

Show how to construct a Boolean circuit C such that, if we create variables only for the inputs of C and then try to build a Boolean formula that is equivalent to C, then we will create a formula...

-

Consider model (9.18). What is the effect on the model parameter estimates, their standard errors, and the goodness-of-fit statistics when (a) The times at risk are doubled, but the numbers of deaths...

-

An auto plant that costs $100 million to build can produce a new line of cars that will generate cash flows with a present value of $140 million if the line is successful, but only $50 million if it...

-

Agnes Magna has found some errors in her data (see Section 10.3). The corrected figures are as follows: Redraw the decision tree with the changed data. Calculate the value of the option to expand....

-

Ms. Magna has thought of another possibility. She could abandon the venture entirely by selling the plane at the end of the first year. Suppose that the piston-engine plane can be sold for $150,000...

-

A colleague of yours comes to you for advice. S/he's working on a project aimed at improving an urban 6-lane freeway section. This person says to you that the traffic flow for one direction during...

-

Edelman Engines has $18 billion in total assets. Its balance sheet shows $3.6 billion in current liabilities, $12.6 billion in long-term debt, and $1.8 billion in common equity. It has 500 million...

-

Q2 Calculate Net Sales, Cost of the goods Sold, Gross Profit and Net Profit from the following information Gross sales RO 53400 Bank charges RO1654 Cash RO 3200 Owners Equity RO 76000 Depreciation RO...

Study smarter with the SolutionInn App