The controller of the Largay Corporation wished to estimate his cash needs for the coming six months.

Question:

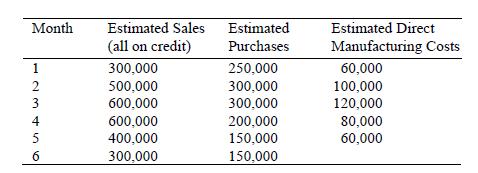

The controller of the Largay Corporation wished to estimate his cash needs for the coming six months. The controller, his salesmen, and production men constructed the following sales and purchase and operating expense schedule.

The company had cash expenses of about $45,000 a month in administrative and overhead costs. The controller also had the following cash obligations to meet:

a. In month 3 a tax payment of $160,000.

b. In month 4 a semiannual interest payment of $20,000 plus $40,000 for the sinking fund.

c. In months 3 and 6 regular quarterly dividends of $30,000 per quarter. Standard terms for the Largay Corporation sales were 2/10, n/30 e.o.m. The Largay Corporation received terms 3/10, n/30 e.o.m. on its own purchases. The controller estimated that about 75 per cent of his accounts receivable were collected the following month. About 80 per cent of the collections were entitled to the cash discount.

The working capital accounts at the beginning of the six month period were as follows:

The controller wishes to maintain a minimum cash balance of $200,000. Since his collections and the bulk of his payments come about the same time of the month, he foresees no intra-monthly difficulties.

Construct a cash budget for the controller so that he can estimate his financing needs for the coming period.

Step by Step Answer:

Quantitative Corporate Finance

ISBN: 9781402070198

1st Edition

Authors: John B. Guerard, Jr.; Eli Schwartz